Description

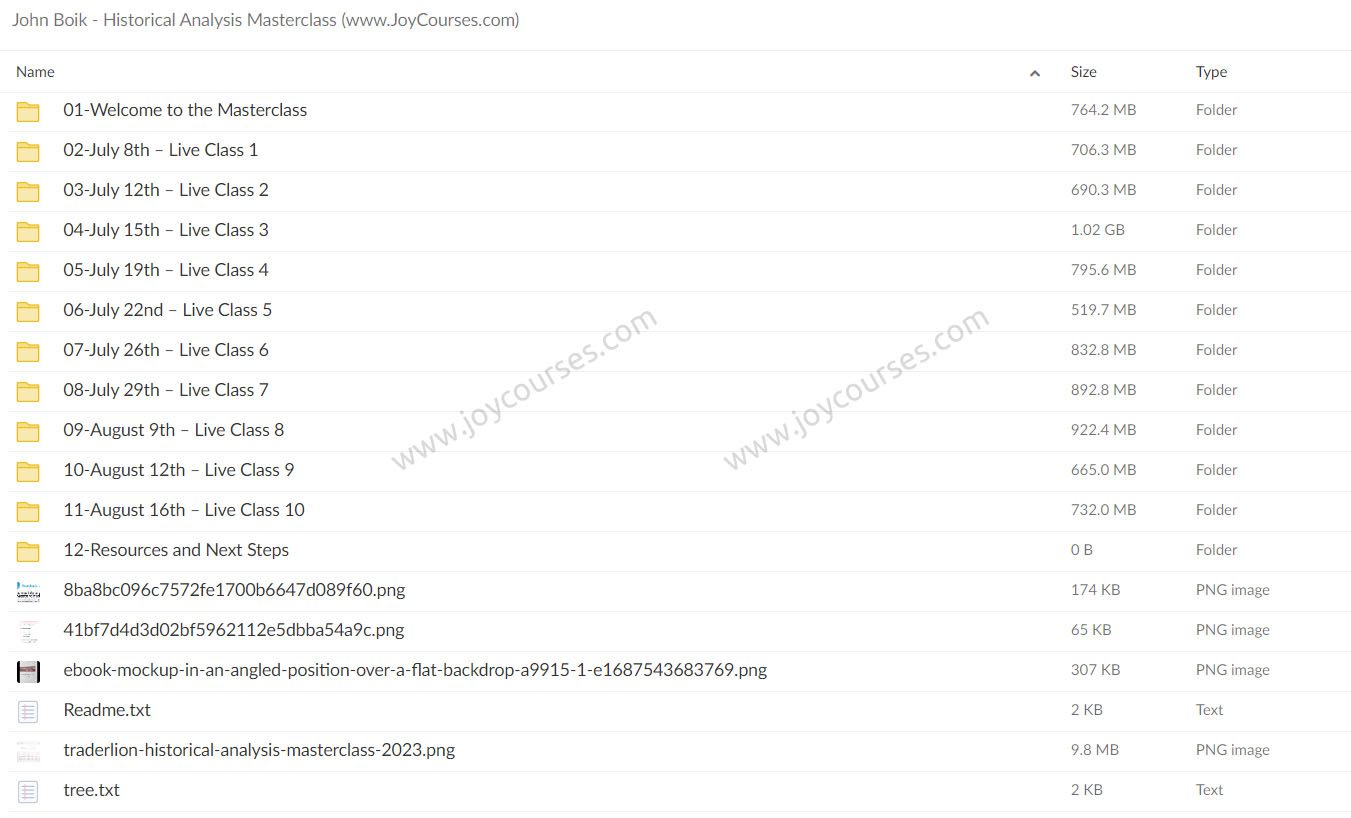

Download Proof | John Boik – Historical Analysis Masterclass (8.38 GB)

![]()

John Boik – Historical Analysis Masterclass Overview

John Boik’s Historical Analysis Masterclass is an immersive course designed to provide a deep understanding of the trading strategies and market dynamics that have shaped the financial landscape over the past century. By exploring the techniques of legendary traders from various eras, this course equips modern investors with the insights needed to navigate today’s complex markets.

Course Structure

Introduction

- Purpose: The course begins with an introduction to the importance of studying the strategies and successes of legendary traders. By analyzing their approaches, students gain valuable insights that can be applied to modern trading.

- Historical Impact: Emphasis is placed on how these traders not only amassed wealth but also influenced the evolution of trading practices.

Legendary Traders Part 1: Early 20th Century Pioneers

- Jesse Livermore: Known for his pioneering techniques in stock trading, Livermore’s story and methods provide a foundational understanding of market speculation and trend following.

- Bernard Baruch: Baruch’s strategies during volatile markets are dissected to highlight his risk management and market timing approaches.

Legendary Traders Part 2 & Other Great Traders

- Warren Buffett: The “Oracle of Omaha” is explored for his long-term value investing philosophy and his ability to identify undervalued companies.

- George Soros: Known for his macroeconomic bets and currency trades, Soros’s strategies are analyzed for their application in global markets.

- Lesser-Known Influencers: The course also covers influential traders who, despite being less famous, have made significant contributions to trading strategies and market evolution.

Modern Legendary Traders & Commonalities

- Ray Dalio: Dalio’s principles of risk parity and diversification are explored, along with his approach to understanding economic cycles.

- Paul Tudor Jones: The course examines Jones’s use of technical analysis and his ability to predict and profit from market downturns.

- Common Threads: The course identifies common strategies and mindsets shared by legendary traders across different eras, offering timeless principles for modern traders.

Monster Stock Templates & New Highs/New Lows

- Identifying Market Leaders: Students learn to identify Monster Stock Templates, which are key indicators of potential market leaders.

- Market Health Indicators: The dynamics of New Highs/New Lows are analyzed to gauge overall market health and predict potential turning points.

Historic Cycles & Monster Stocks by Decade

- 1900 – 1940s: Exploration of historic cycles and Monster Stocks during the early 20th century, focusing on the effects of industrialization and the Great Depression.

- 1950 – 1970s: Analysis of the post-war economic boom, the rise of conglomerates, and the impact of the Cold War on markets.

- 1980 – 1990s: Examination of the technological revolution, globalization, and the emergence of information technology stocks.

- 2000 – 2010s: Insight into the dot-com bust, the 2008 financial crisis, and the recovery strategies that followed.

- 2020 – Present: The course concludes with an analysis of the most recent market cycles, including the COVID-19 pandemic’s impact and the emergence of new market leaders.

Putting It All Together

- Synthesis of Knowledge: The final sections synthesize the information gathered throughout the course, helping students apply historical lessons to current market conditions.

- Current Market Analysis: Students assess current market conditions using the principles learned from legendary traders and historical cycles.

- Summary and Lessons Learned: Key insights and lessons are summarized to reinforce the course’s teachings.

- Additional Resources: For those eager to delve deeper, the course offers additional resources and reading materials.

Why Enroll in the Historical Analysis Masterclass?

- Comprehensive Knowledge: Gain an in-depth understanding of the strategies that have shaped the financial world over the past century.

- Practical Application: Learn how to apply historical insights to current market conditions, enhancing your ability to make informed trading decisions.

- Timeless Wisdom: The course offers timeless principles that transcend market conditions, providing valuable tools for traders of all experience levels.

Enroll Now

If you’re serious about deepening your understanding of trading strategies and market dynamics, John Boik’s Historical Analysis Masterclass is the perfect course for you. With its rich exploration of legendary traders and market cycles, this course will arm you with the knowledge and skills needed to succeed in today’s financial markets.