Description

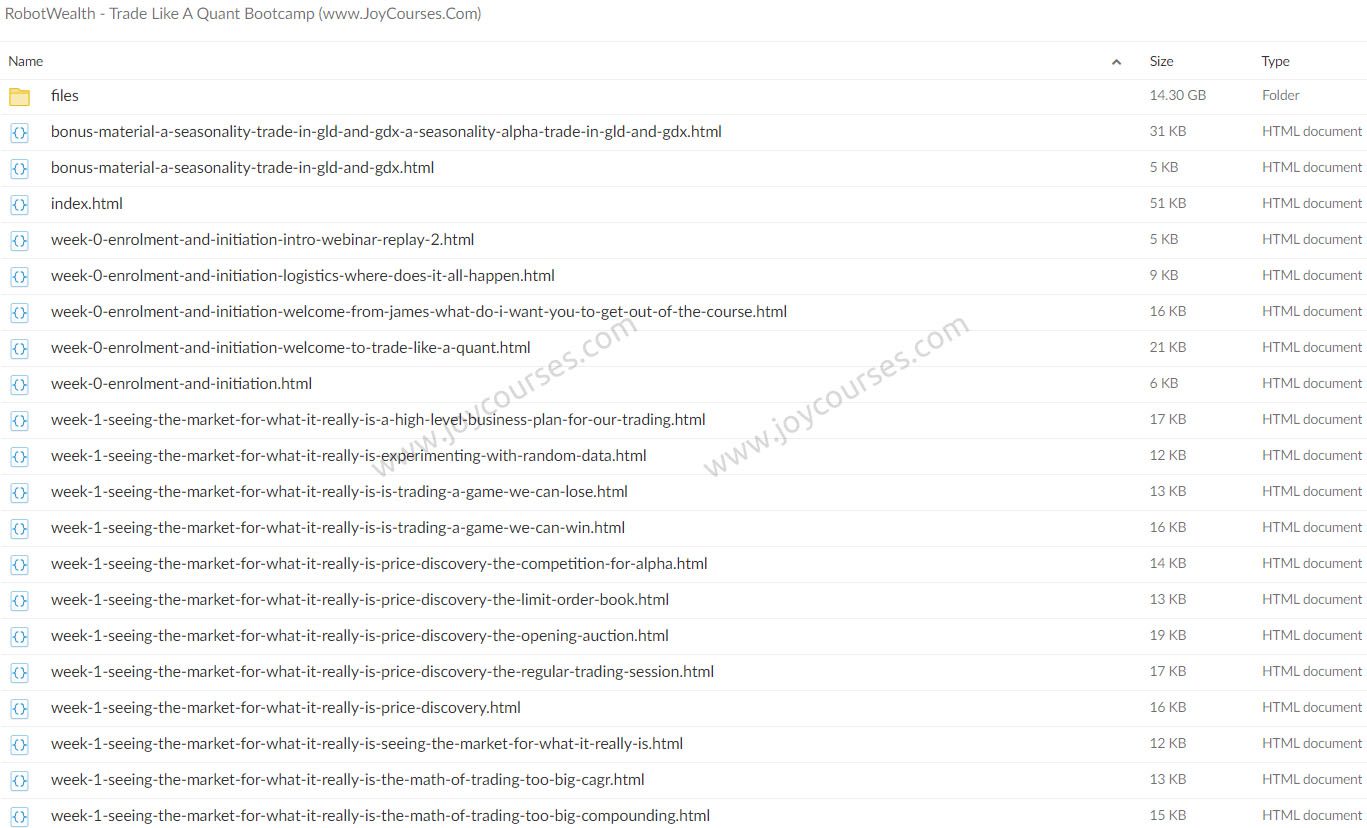

Download Proof | RobotWealth – Trade Like A Quant Bootcamp (14.30 GB)

![]()

RobotWealth – Trade Like A Quant Bootcamp

Introduction:

The “Trade Like A Quant Bootcamp” by RobotWealth is designed for traders and investors who want to adopt a quantitative approach to financial markets. Whether you’re a beginner or an experienced trader, this bootcamp offers an in-depth exploration of systematic trading, quantitative strategies, and data-driven decision-making, giving you the tools and knowledge to trade like a quant.

Course Overview:

The Trade Like A Quant Bootcamp focuses on empowering participants with a quantitative trading mindset. It covers the complete process of building, testing, and executing systematic trading strategies using quantitative techniques. Participants will gain hands-on experience with real-world tools and techniques employed by professional quants in hedge funds and proprietary trading firms.

What You’ll Learn:

- Quantitative Trading Fundamentals:

- Introduction to quantitative trading and its advantages over discretionary methods.

- How quants use data to identify patterns and make decisions.

- The importance of removing emotion and bias from trading.

- Strategy Development:

- Frameworks for developing and testing trading strategies using historical data.

- Understanding statistical significance and the use of proper backtesting techniques to avoid overfitting.

- Identifying market inefficiencies and developing alpha-generating strategies.

- Risk Management and Optimization:

- Implementing robust risk management principles to control drawdowns and manage portfolio risk.

- Techniques for position sizing, portfolio diversification, and capital allocation.

- How to optimize strategies for different market conditions.

- Algorithmic Execution:

- Automating strategies using algorithmic trading frameworks.

- Learning the principles behind high-frequency trading (HFT), execution algorithms, and order book analysis.

- Utilizing Python, R, and other programming languages to code and execute strategies.

- Advanced Quant Techniques:

- Explore machine learning and artificial intelligence techniques for trading.

- How to use factor models, statistical arbitrage, and market-making strategies.

- Applying Monte Carlo simulations and probability theory to enhance strategy robustness.

Hands-On Learning:

Throughout the bootcamp, participants will work on practical projects and case studies that mirror real-world quant trading challenges. You’ll learn how to:

- Build and backtest your own quantitative strategies.

- Analyze financial data using tools like Python, Jupyter Notebooks, and QuantLib.

- Develop trading algorithms that can be deployed in live markets.

Who Is It For?

This bootcamp is suitable for:

- Retail traders looking to transition from discretionary to systematic trading.

- Data scientists and programmers interested in applying their skills to the financial markets.

- Finance professionals who want to expand their understanding of quantitative methods.

Key Takeaways:

By the end of the Trade Like A Quant Bootcamp, you’ll be able to:

- Design, test, and deploy data-driven trading strategies like professional quants.

- Utilize tools like Python and financial libraries to build trading models.

- Apply machine learning and statistical methods to discover new trading opportunities.

- Manage risk effectively and improve the overall profitability of your trading system.

Conclusion:

The RobotWealth – Trade Like A Quant Bootcamp offers an immersive and practical guide into the world of quantitative trading. Whether you’re looking to enhance your existing trading skills or break into the world of systematic trading, this bootcamp provides the expertise and resources to help you trade with confidence and precision, just like a quant.

Start trading like the pros and gain a competitive edge in the markets with this cutting-edge bootcamp!