Description

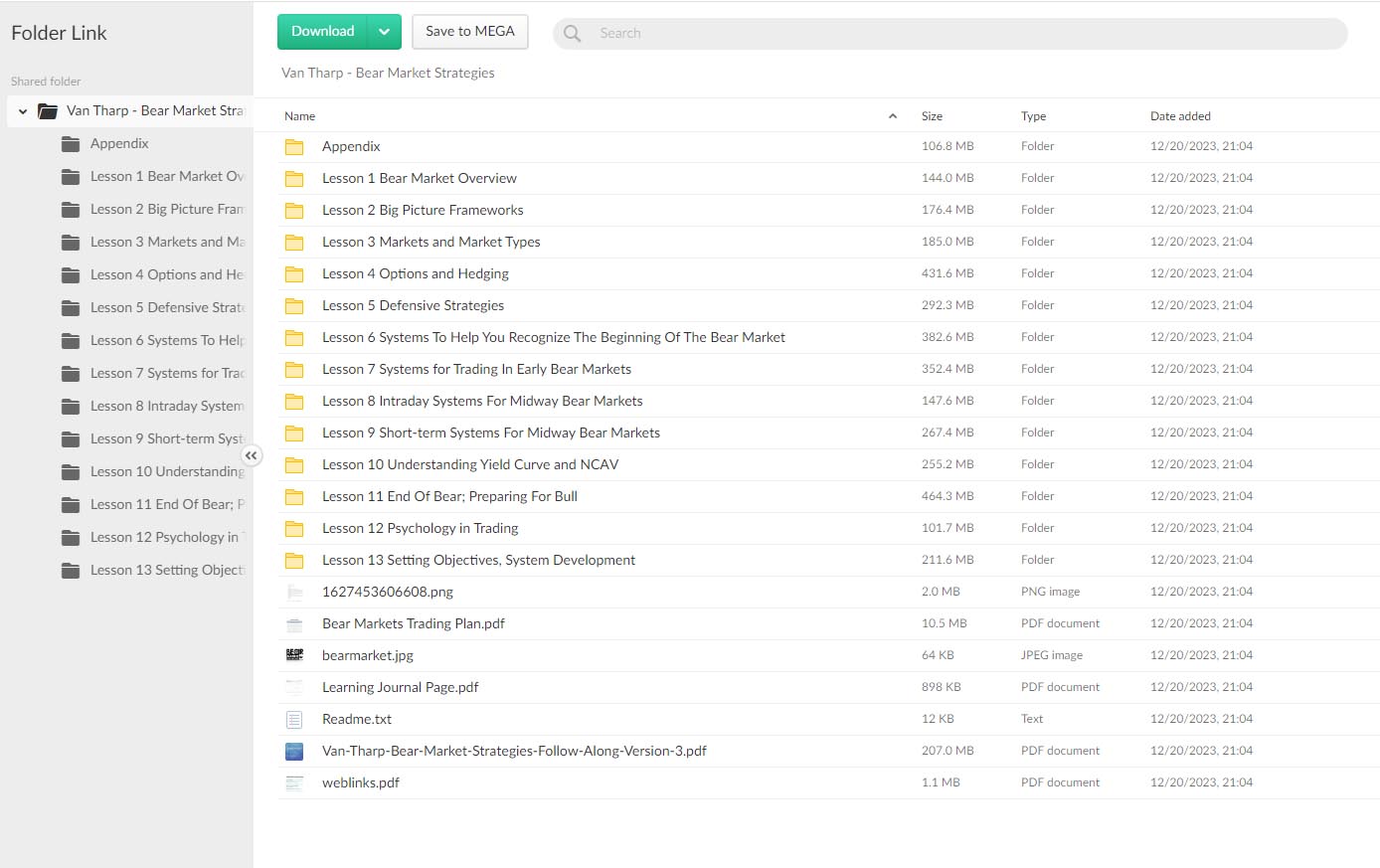

Download Proof |Van Tharp – Bear Market Strategies (3.65 GB)

![]()

Van Tharp’s Bear Market Strategies course is designed to equip traders and investors with the tools and strategies needed to navigate and profit from bear markets, which are often characterized by prolonged periods of falling stock prices. Van Tharp, a well-known trading coach and author, focuses on preparing traders to manage risk effectively while capitalizing on the unique opportunities presented by market downturns.

Key Features of the Course:

- Understanding Market Cycles:

- The course covers the phases of market cycles, with a special emphasis on recognizing when a bull market transitions into a bear market.

- Traders learn to identify early signs of market weakness and prepare accordingly.

- Psychology of Bear Markets:

- Van Tharp emphasizes the importance of mindset in bear markets. Many traders struggle with fear and panic during market declines, so the course includes strategies to manage emotions and remain disciplined.

- It also covers how to handle the psychological biases that often prevent traders from profiting in down markets.

- Risk Management:

- As with all of Van Tharp’s teachings, risk management is a critical component. The course teaches techniques for limiting losses during market declines while positioning yourself to benefit from future opportunities.

- Stop-loss placements, position sizing, and other risk controls are covered extensively.

- Bear Market Trading Strategies:

- The course offers a variety of actionable trading strategies tailored to bear markets. These include short-selling techniques, using inverse ETFs, options strategies (such as puts and protective strategies), and market timing methods.

- Van Tharp also discusses how to hedge portfolios to protect against further losses.

- Asset Diversification and Defensive Positions:

- Traders and investors are taught how to allocate their capital defensively in a bear market, focusing on sectors and asset classes that perform better in times of economic contraction, such as precious metals, bonds, and defensive stocks.

- Diversification strategies are also discussed to minimize risk while maintaining exposure to growth opportunities.

- Tailoring Strategies to Individual Needs:

- Tharp encourages traders to understand their personal trading style and risk tolerance to select strategies that best suit their individual circumstances.

- The course integrates concepts from his broader teachings on trading psychology and system development.

This course is suitable for traders who want to protect their portfolios during downturns and for those looking to profit from bearish market movements.

View More Courses : Click Here

Become a member at : Click Here