Description

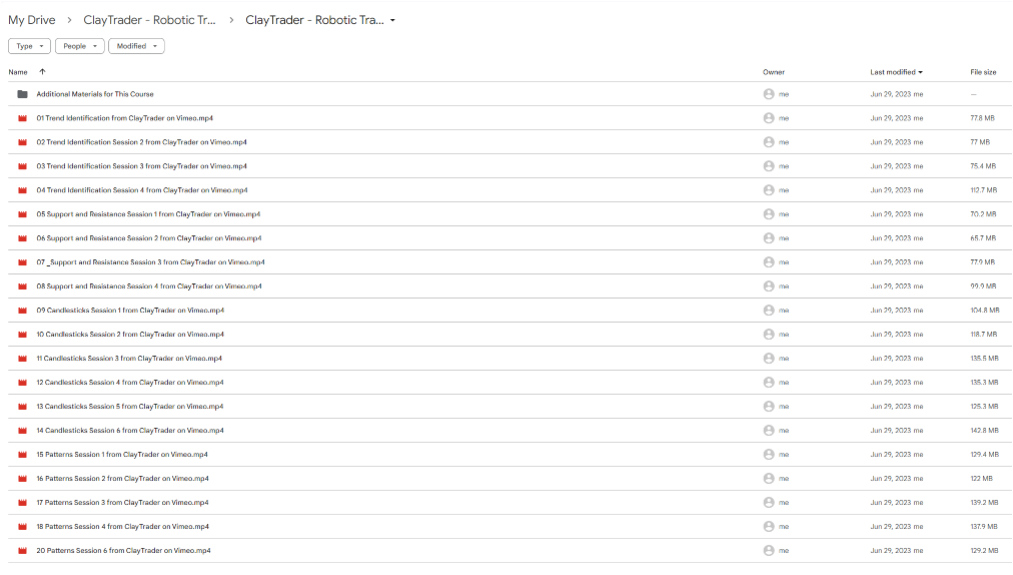

Download Proof | ClayTrader – Robotic Trading Skill Sharpening (3.20 GB)

![]()

ClayTrader’s Robotic Trading Skill Sharpening course is an advanced trading program designed to help traders develop precision and discipline by focusing on technical analysis, chart patterns, and risk management. It’s aimed at individuals who want to strengthen their ability to make unemotional, calculated trading decisions, which is often described as “robotic” due to its focus on systematic and repeatable methods.

Here’s an outline of what Robotic Trading Skill Sharpening typically covers:

1. Mastering Technical Analysis Fundamentals

- Understanding Price Action: How to read price movement without relying on multiple indicators, focusing on pure price data to interpret market sentiment.

- Key Support and Resistance Levels: Identifying critical price levels that serve as potential entry and exit points.

- Candlestick Patterns: Using candlestick analysis to predict market reversals, continuations, and setups for precise entries.

2. Advanced Chart Pattern Recognition

- Pattern Consistency and Accuracy: Techniques for recognizing and trading chart patterns like triangles, channels, head and shoulders, and flags.

- Breakout and Reversal Patterns: Learning to spot breakout and reversal opportunities to trade with confidence in various market conditions.

- Volume Analysis: Understanding the role of volume in confirming or rejecting patterns and the strength of price movements.

3. Indicator Integration for Precision

- Moving Averages: Using moving averages to establish trend direction, support, and resistance levels.

- RSI, MACD, and Stochastics: Applying key indicators to enhance timing for entries and exits, while preventing over-reliance on any single indicator.

4. Sharpening Entry and Exit Strategies

- Exact Entry Techniques: Steps for setting up high-probability entries based on price action and indicators.

- Exit Strategies and Profit Targets: Techniques for planning exits, setting profit targets, and trailing stops for maximum return with minimized risk.

5. Creating a Robotic Trading Plan

- Defining Rules for Every Trade: Developing strict rules for entries, exits, and position sizing to ensure consistent, emotion-free trades.

- Pre-Trade Preparation: Establishing a structured routine to prepare for trades and follow a trading plan without hesitation.

6. Risk and Money Management Mastery

- Position Sizing for Risk Control: Techniques for calculating optimal position sizes based on risk tolerance and account size.

- Stop Loss and Take Profit Rules: Using stop-loss orders effectively to protect capital and determining when to take profits.

- Avoiding Emotional Trading: Psychological strategies to stay disciplined and avoid fear or greed-driven decisions.

7. Strengthening Trading Discipline and Focus

- Developing a Robotic Mindset: Techniques to train the mind to focus on process over outcomes, reducing stress and emotional interference.

- Consistency in Execution: Methods to reinforce disciplined execution and stick to the trading plan.

8. Real-World Trading Simulations

- Practical Trade Examples: Reviewing example trades in various scenarios, analyzing the logic, entries, and outcomes.

- Simulated Practice: Opportunities for practice through simulations to apply skills learned without the emotional impact of real money.

9. Self-Review and Continuous Improvement

- Journaling Trades and Learning from Mistakes: Importance of tracking each trade to identify patterns in success and areas for improvement.

- Analyzing Performance Metrics: Reviewing win/loss ratios, average profit/loss, and risk/reward ratios to refine strategies over time.

10. Access to Community and Support

- Discussion and Peer Feedback: Access to a community where traders can share insights, experiences, and get feedback.

- Mentorship Opportunities: Support through mentoring sessions or live Q&As to answer questions and reinforce concepts.

ClayTrader’s Robotic Trading Skill Sharpening is designed for traders who are serious about building a rules-based approach to trading, with a focus on process-driven decision-making and technical analysis. By the end of the course, participants should have a refined approach to trading that minimizes emotions and maximizes precision and consistency.