Description

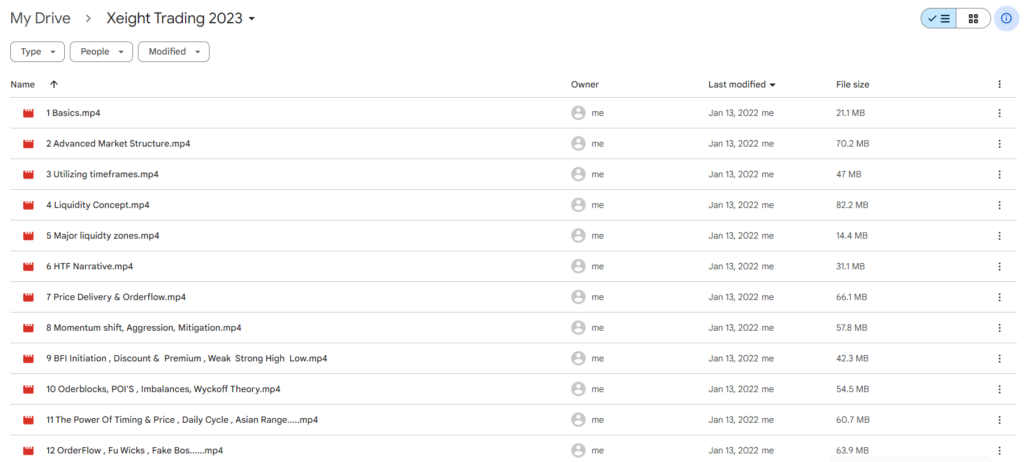

Download Proof | Xeight Trading 2023 (781 MB)

![]()

Xeight Trading 2023 is a trading course focusing on advanced trading strategies, technical analysis, and a structured approach to risk management. This program is usually intended for intermediate to advanced traders who want to deepen their skills in markets such as forex, stocks, and cryptocurrencies. Xeight Trading emphasizes high-level technical insights and psychology-driven trading.

Here’s an outline of what Xeight Trading 2023 often covers:

1. Core Principles of Market Analysis

- Market Structure: Understanding phases in market movement, from accumulation to distribution, to recognize profitable entry and exit points.

- Order Flow and Liquidity: Analyzing order flow and liquidity zones to spot institutional moves and anticipate market reversals.

- Support and Resistance Zones: Identifying and interpreting key levels that provide reliable entry and exit signals.

2. Advanced Price Action Techniques

- Candlestick Patterns: Learning to read candlestick formations for reversals, continuations, and high-probability setups.

- Price Action Without Indicators: Focusing on reading the market without relying on indicators, allowing traders to interpret pure price movement.

- Multiple Timeframe Analysis: Using higher and lower timeframes in conjunction to strengthen trade setups and increase probability of success.

3. Technical Analysis and High-Probability Patterns

- Chart Pattern Mastery: Recognizing and trading classic patterns like double tops/bottoms, head and shoulders, and ascending/descending channels.

- Breakout and Retest Trading: Techniques for capturing price momentum by identifying breakouts and waiting for reliable retests.

- Volume Analysis: Using volume to confirm trends and breakouts, enhancing accuracy in price interpretation.

4. Smart Money and Institutional Trading Concepts

- Institutional Order Flow: Learning how large institutional players influence price movements and identifying institutional footprints in the market.

- Smart Money Concepts (SMC): Leveraging concepts such as order blocks, liquidity grabs, and imbalance to predict market moves.

- Wyckoff Theory: Understanding accumulation, distribution, markup, and markdown phases according to Wyckoff principles to anticipate shifts in trend.

5. Risk Management and Capital Preservation

- Position Sizing: Setting trade sizes based on account size, risk tolerance, and specific market conditions to minimize loss.

- Stop Loss and Take Profit Strategy: Setting stop losses based on price structure and volatility to protect capital and secure profits.

- Drawdown Management: Techniques for managing losing streaks to ensure long-term sustainability and protect gains.

6. Scalping and Swing Trading Strategies

- Scalping Techniques: Strategies for short-term trades, focusing on quick, profitable trades with tight risk management.

- Swing Trading for Larger Moves: Identifying and capturing medium to longer-term price moves with a focus on major trend analysis.

- Hybrid Trading Approaches: Combining aspects of scalping and swing trading to adapt to various market conditions.

7. Trader Psychology and Mindset

- Building Mental Resilience: Techniques for staying composed during both winning and losing streaks to make objective decisions.

- Avoiding Common Psychological Traps: Recognizing and counteracting emotional biases such as fear, greed, and revenge trading.

- Routine and Discipline: Creating a daily routine to instill discipline, limit impulsive trades, and enhance consistency.

8. Developing a Personal Trading System

- Creating a Structured Trading Plan: Building a personal plan that includes goals, trade criteria, risk parameters, and performance metrics.

- Backtesting and Forward Testing: How to test trading strategies against historical and live data to ensure robustness and consistency.

- Trade Journaling and Analysis: Using a trade journal to track performance, identify strengths and weaknesses, and continuously improve.

9. Trading Tools and Platform Proficiency

- Trading Platform Mastery: Getting familiar with charting tools like TradingView, MetaTrader, and other analysis software.

- Using Alerts and Notifications: Setting up alerts to monitor price levels and key market events without constant screen time.

- Indicator Usage: Introduction to popular indicators (when appropriate) and how to incorporate them sparingly to support analysis.

10. Community and Mentorship Access

- Engagement in Trader Community: Connecting with other traders to share insights, discuss strategies, and learn from different perspectives.

- Q&A and Mentorship Opportunities: Access to Q&A sessions, live webinars, and mentorship to reinforce learning and address challenges.

Xeight Trading 2023 aims to build traders who are independent, disciplined, and able to adapt to various market conditions through a robust understanding of advanced technical and psychological techniques. It provides valuable insights and methods for anyone looking to elevate their trading in forex, stocks, or crypto markets.