Description

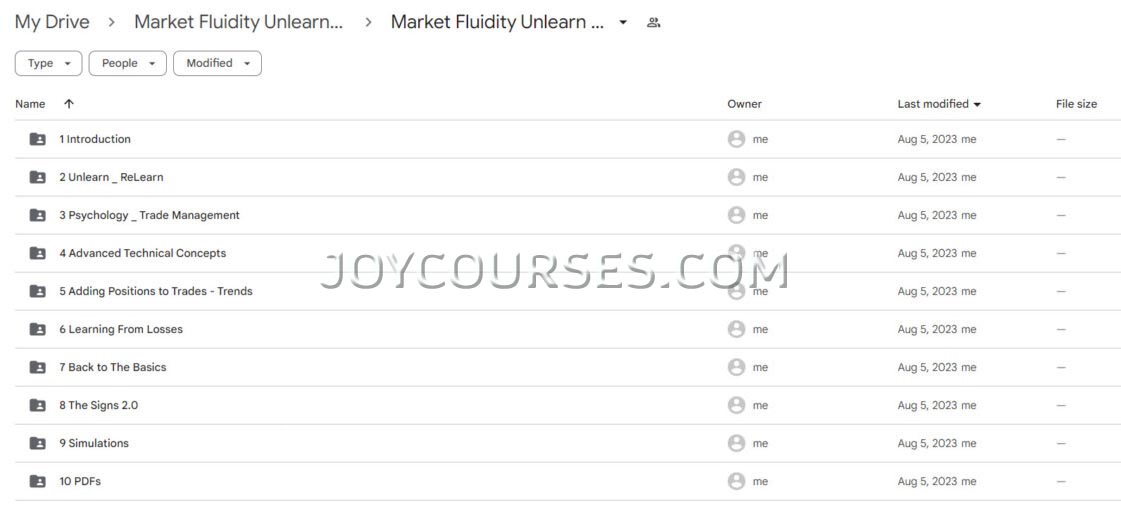

Download proof | Market Fluidity Unlearn and Relearn (13.3 GB)

![]()

Market Fluidity: Unlearn and Relearn is a trading course designed to help traders adapt to the dynamic nature of financial markets. The course focuses on deconstructing traditional trading beliefs and practices that may no longer be effective, encouraging participants to adopt a more flexible, open-minded approach to trading. This program emphasizes the importance of continuous learning and adapting to changing market conditions.

Here’s an overview of what Market Fluidity: Unlearn and Relearn typically covers:

1. Understanding Market Dynamics

- Market Structure: Analyzing the underlying structure of different markets (forex, stocks, commodities) to understand how they move.

- Behavioral Economics: Exploring how trader psychology and behavior impact market movements and trends.

- Market Sentiment Analysis: Learning to gauge market sentiment and its influence on price action, using tools like news analysis and sentiment indicators.

2. Challenging Conventional Trading Beliefs

- Identifying Limiting Beliefs: Recognizing common myths and misconceptions about trading that may hinder performance.

- Rethinking Technical Analysis: Exploring the limitations of traditional technical analysis and discovering alternative analytical methods.

- Adapting to Market Conditions: Understanding the need to modify strategies based on varying market environments (trending vs. ranging markets).

3. Fluid Trading Strategies

- Price Action Trading: Focusing on reading price movements and market behavior without relying heavily on indicators.

- Dynamic Risk Management: Adopting flexible risk management strategies that adjust to market volatility and personal trading style.

- Multiple Timeframe Analysis: Utilizing multiple timeframes to gain a comprehensive view of market trends and pinpoint entry/exit opportunities.

4. Continuous Learning and Adaptation

- Importance of Feedback Loops: Establishing a system for analyzing trades and learning from both wins and losses.

- Staying Updated with Market Trends: Engaging in ongoing education, following market news, and adapting to changes in financial regulations and technologies.

- Building a Learning Community: Connecting with other traders to share insights, strategies, and experiences to foster continuous improvement.

5. Practical Application and Real-World Scenarios

- Case Studies and Examples: Analyzing real-world trading scenarios to illustrate how to apply fluidity principles in practice.

- Live Trading Sessions: Participating in live trading sessions to implement learned concepts and receive feedback in real-time.

- Developing a Personalized Trading Plan: Crafting a trading plan that reflects individual goals, risk tolerance, and preferred trading styles while allowing for flexibility.

6. Mindset and Psychological Resilience

- Building Mental Agility: Developing the ability to adapt quickly to market changes and respond effectively under pressure.

- Overcoming Emotional Barriers: Strategies for managing emotions such as fear and greed that can impede decision-making.

- Creating a Growth Mindset: Fostering an attitude that embraces challenges, seeks feedback, and values learning over perfection.

7. Integrating Technology in Trading

- Using Trading Tools and Software: Familiarizing oneself with modern trading platforms, tools, and resources that enhance analysis and execution.

- Algorithmic Trading Basics: Introduction to algorithmic trading concepts and how to leverage technology for better decision-making.

- Data Analysis and Interpretation: Learning to analyze data effectively to inform trading decisions and strategies.

Market Fluidity: Unlearn and Relearn aims to equip traders with the skills and mindset needed to navigate the complexities of the financial markets effectively. By encouraging flexibility and a willingness to adapt, the course seeks to empower traders to achieve better outcomes and maintain longevity in their trading careers.