Description

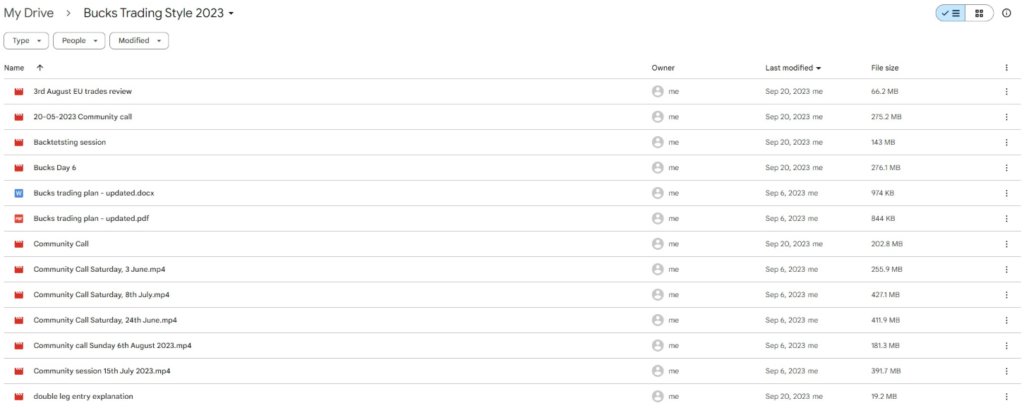

Download proof | Bucks Trading Style 2023 (6.16 GB)

![]()

Bucks Trading Style 2023 is a trading course focused on teaching participants a specific trading methodology that emphasizes consistent profitability and risk management. This program is often aimed at both beginners and experienced traders, providing strategies and insights applicable across various markets, including forex, stocks, and cryptocurrencies. The course emphasizes practical techniques and a disciplined approach to trading.

Here’s an overview of what Bucks Trading Style 2023 typically includes:

1. Introduction to Bucks Trading Style

- Understanding the Basics: Overview of key concepts in trading and the philosophy behind the Bucks Trading Style.

- Market Analysis Framework: Learning how to analyze different markets effectively to identify potential trading opportunities.

2. Trading Strategies and Techniques

- Core Trading Strategies: Detailed explanation of specific strategies used in the Bucks Trading Style, including entry and exit points.

- Price Action Trading: Emphasizing the importance of reading price movements and understanding market trends without relying heavily on indicators.

- Trend Following and Reversal Strategies: Techniques for identifying and trading with the trend, as well as recognizing potential reversal points.

3. Technical Analysis Skills

- Chart Patterns and Candlestick Analysis: Identifying key chart patterns and candlestick formations that signal potential trades.

- Support and Resistance Levels: Learning to recognize and utilize support and resistance zones to make informed trading decisions.

- Indicator Utilization: Introduction to specific indicators that can enhance decision-making while maintaining a primary focus on price action.

4. Risk Management and Money Management

- Capital Preservation Strategies: Techniques for protecting trading capital and managing risk effectively.

- Position Sizing and Risk-to-Reward Ratios: Understanding how to calculate appropriate position sizes and set realistic risk-to-reward ratios for each trade.

- Establishing Stop Loss and Take Profit Levels: Guidelines for placing stop-loss orders and take-profit targets to safeguard against significant losses.

5. Psychological Aspects of Trading

- Building a Trader’s Mindset: Developing the right mindset for trading, including discipline, patience, and emotional control.

- Overcoming Psychological Barriers: Strategies for dealing with common psychological challenges such as fear, greed, and overtrading.

- Maintaining Consistency: Techniques for developing a consistent trading routine and staying focused on long-term goals.

6. Practical Application and Live Trading

- Live Trading Sessions: Participating in live trading demonstrations to see the Bucks Trading Style in action.

- Analyzing Trade Performance: Reviewing past trades to identify strengths, weaknesses, and areas for improvement.

- Creating a Trading Journal: Maintaining a journal to track trades, analyze outcomes, and reflect on performance.

7. Developing a Personalized Trading Plan

- Crafting a Trading Strategy: Building a personalized trading strategy that aligns with individual goals, risk tolerance, and trading style.

- Setting Realistic Goals: Establishing achievable trading goals and creating a roadmap to reach them.

- Adapting to Market Conditions: Learning how to adjust trading strategies based on changing market dynamics.

8. Community and Support

- Engaging with a Trading Community: Connecting with other traders to share insights, strategies, and experiences for collective growth.

- Access to Resources and Tools: Utilizing additional resources, tools, and ongoing support to enhance trading skills and knowledge.

Bucks Trading Style 2023 aims to provide traders with a comprehensive understanding of effective trading practices while emphasizing discipline and risk management. By combining practical techniques with psychological insights, the course seeks to empower traders to achieve consistent profitability and success in their trading endeavors.