Description

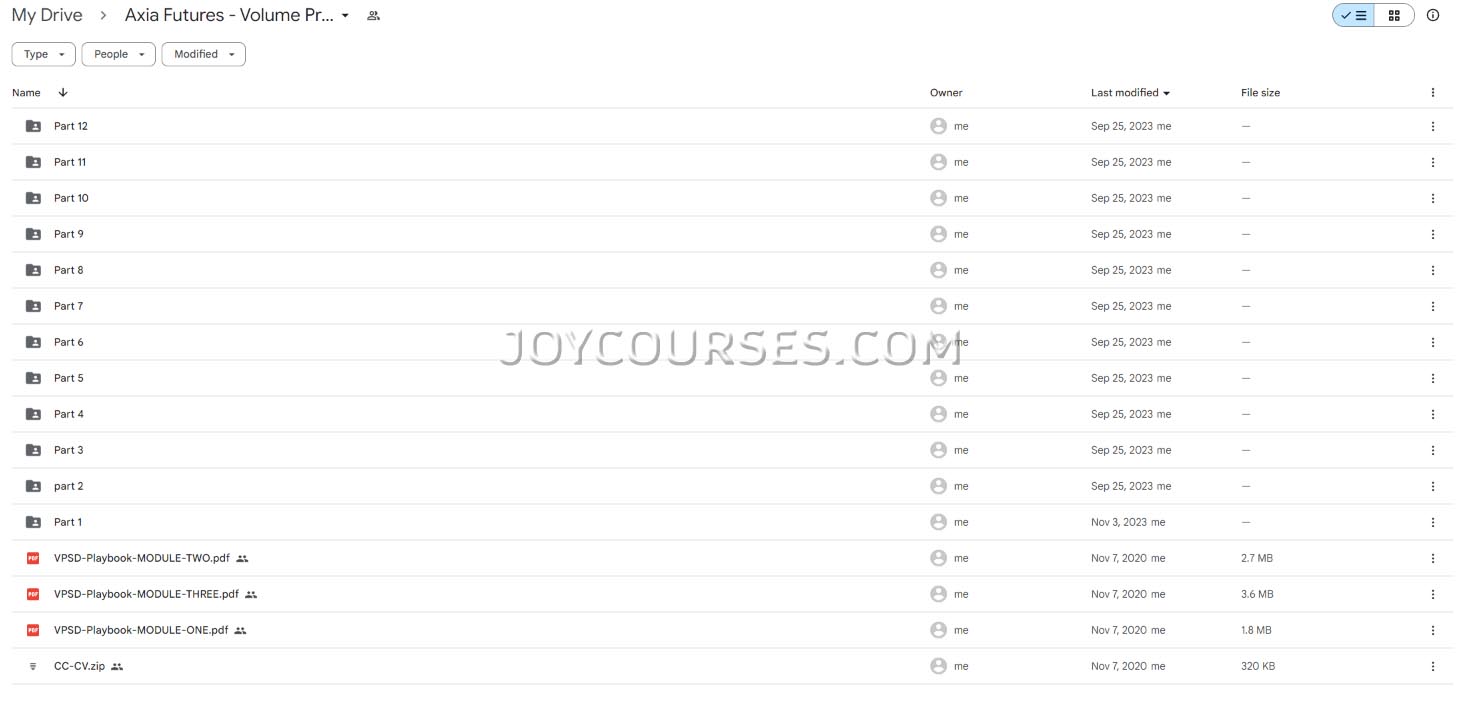

Download proof | Axia Futures – Volume Profiling with Strategy Development (23.2 GB)

![]()

Axia Futures – Volume Profiling with Strategy Development is an educational course aimed at traders who want to enhance their market analysis skills and develop effective trading strategies using volume profiling techniques. Volume profiling is a trading analysis method that focuses on the distribution of traded volume at various price levels, providing insights into market behavior, support and resistance levels, and potential future price movements.

Here’s an overview of what the course typically covers:

1. Introduction to Volume Profiling

- Understanding Volume Profiling: An overview of what volume profiling is and how it differs from traditional price analysis.

- Importance of Volume in Trading: Exploring the role of volume in confirming price movements and market trends.

- Key Concepts: Introduction to key terms such as Value Area, Point of Control (POC), and High Volume Nodes (HVN).

2. Volume Profile Construction

- Creating a Volume Profile: Step-by-step guidance on how to create and interpret a volume profile chart.

- Analyzing Historical Data: Techniques for using historical volume data to inform future trading decisions.

- Understanding Market Structure: How volume profiles can reveal the market structure and behavior over time.

3. Identifying Key Levels with Volume Profiling

- Support and Resistance: Using volume profiles to identify key support and resistance levels based on trading activity.

- Value Areas: Understanding the significance of the Value Area and how it indicates areas of high trading interest.

- POC Analysis: Analyzing the Point of Control to determine where the most trading activity occurred, signaling potential reversal or continuation zones.

4. Strategy Development Using Volume Profiling

- Developing Trading Strategies: Creating strategies based on volume profile insights, incorporating price action and market context.

- Entry and Exit Criteria: Establishing rules for entering and exiting trades based on volume profile signals.

- Combining Volume Profiling with Other Indicators: Integrating volume profiling with other technical indicators (e.g., moving averages, RSI) to strengthen trading strategies.

5. Risk Management and Position Sizing

- Risk Assessment: Understanding the risks associated with different trading strategies and how volume profiling can help mitigate them.

- Position Sizing Techniques: Learning how to determine appropriate position sizes based on account size, risk tolerance, and market conditions.

- Setting Stop Loss and Take Profit Levels: Guidelines for effectively placing stop losses and take profits based on volume profile analysis.

6. Live Trading Examples and Case Studies

- Real-Time Trading Analysis: Opportunities to analyze live market conditions using volume profiling techniques.

- Case Studies of Successful Trades: Examining past trades where volume profiling played a key role in decision-making.

- Interactive Q&A Sessions: Engaging with instructors and peers to discuss specific trading scenarios and volume profile applications.

7. Psychological Aspects of Trading

- Managing Emotions in Trading: Techniques for handling emotions and maintaining discipline when trading based on volume profiles.

- Building Confidence: Developing the confidence to trust volume profile analysis in making trading decisions.

- Maintaining a Growth Mindset: Emphasizing continuous learning and adaptability in trading strategies.

8. Tools and Resources

- Trading Platforms and Software: Recommendations for trading platforms that support volume profiling and analysis.

- Resources for Continued Learning: Additional reading materials, tools, and resources for further study of volume profiling and trading strategies.

- Building a Trading Journal: Encouragement to keep a detailed trading journal to document trades, analyze performance, and refine strategies.

The Axia Futures – Volume Profiling with Strategy Development course is designed for traders who want to deepen their understanding of market dynamics and enhance their trading performance through advanced volume analysis techniques. With a focus on practical application and strategy development, participants are equipped with the skills necessary to make informed trading decisions based on volume behavior.