Description

Download Proof | Inner Circle Dragons – The ICT Academy (Course size: 1.42 GB)

![]()

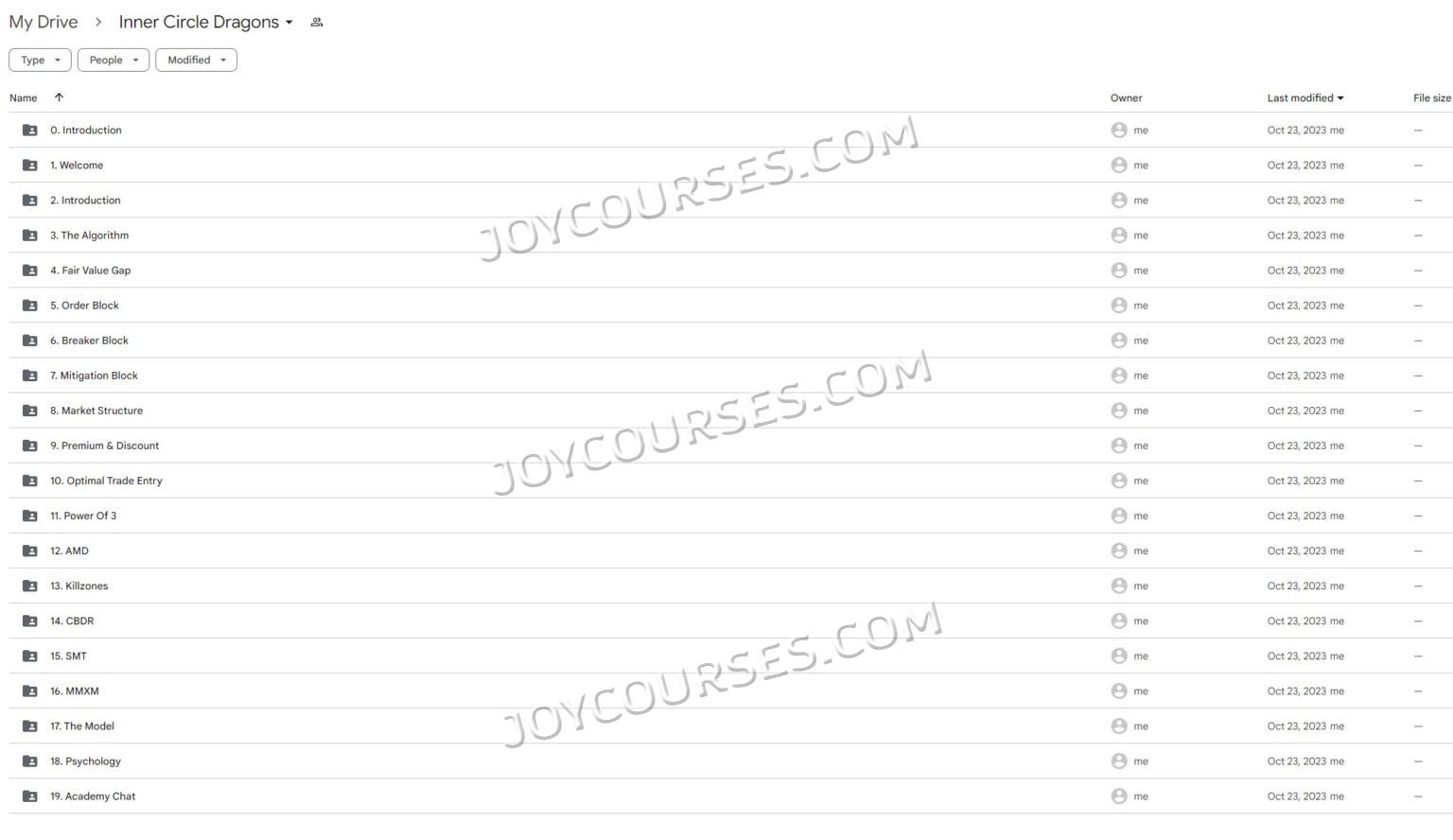

Inner Circle Dragons’ “The ICT Academy” is a specialized course designed to provide an in-depth education on institutional trading concepts, as pioneered by Inner Circle Trader (ICT). This program covers advanced technical analysis, market structure, and trading psychology to help traders understand how financial markets operate from an institutional perspective. Here’s an outline of the key topics and elements of the course:

1. Introduction to Institutional Trading Concepts

- Understanding Market Structure: Key principles of market structure, including identifying highs, lows, support, and resistance levels.

- Smart Money Concepts: An overview of the smart money methodology, focusing on how institutional investors and traders move the markets.

- Liquidity and Manipulation: How liquidity is used by institutions to trigger retail stop-losses, setting up moves in the intended direction.

2. Advanced Technical Analysis

- Price Action Patterns: Identifying and interpreting key price action patterns, including engulfing patterns, order blocks, and imbalances.

- Order Blocks and Fair Value Gaps (FVGs): How to recognize and trade institutional order blocks and fair value gaps that signal significant buying or selling pressure.

- Supply and Demand Zones: Techniques to identify supply and demand zones where institutions are likely to buy or sell in volume.

3. ICT Core Concepts and Strategies

- Market Cycles and Timeframes: Understanding the cyclical nature of markets, and how to use multi-timeframe analysis for better context.

- The Power of Kill Zones: Focusing on specific timeframes, known as “kill zones,” where liquidity spikes and market reversals are more likely.

- Equilibrium and Discount/Premium Zones: Learning to calculate and interpret price levels relative to fair value, aiding in identifying optimal trade setups.

4. Trading Strategy Development

- Institutional Trade Entry Techniques: Exploring specific entry techniques that align with institutional order flow and liquidity concepts.

- Optimal Trade Management: How to set targets based on liquidity pools, support/resistance, and other ICT principles.

- Risk Management and Position Sizing: Importance of proper risk management to maximize gains and minimize losses, with an emphasis on capital preservation.

5. Applying Order Flow Analysis

- Order Flow and Market Depth: Using order flow tools to read market sentiment and institutional activity in real-time.

- Volume and Open Interest: Analyzing volume and open interest in the context of institutional trading strategies.

- Footprint and Volume Profile: How to use footprint and volume profile charts to enhance understanding of market dynamics and institutional behavior.

6. Trading Psychology and Discipline

- Building a Resilient Trading Mindset: Techniques for developing mental resilience and handling the emotional challenges of trading.

- Staying Aligned with Institutional Logic: Training oneself to think and act in alignment with institutional processes rather than retail trading tendencies.

- Journaling and Self-Review: Emphasis on journaling each trade and reviewing performance to foster continuous improvement.

7. Live Trading and Market Analysis

- Real-Time Market Analysis: Engaging in live trading sessions to observe ICT concepts in action and reinforce theoretical knowledge.

- Interactive Strategy Sessions: Reviewing recent trades and market setups to clarify techniques and improve real-world application.

- Q&A and Mentorship: Opportunities for personalized feedback through interactive Q&A sessions with mentors to address specific challenges.

8. Community Access and Continuous Learning

- Peer Support and Networking: Access to a community of traders who share insights, discuss strategies, and offer support.

- Ongoing Course Materials: Access to recorded sessions, updates, and additional resources for continued learning.

Inner Circle Dragons’ “The ICT Academy” is tailored for traders seeking an in-depth understanding of institutional trading principles. By focusing on smart money techniques, liquidity concepts, and psychological resilience, this course aims to empower traders with the knowledge and discipline needed to navigate markets from an institutional perspective.