Description

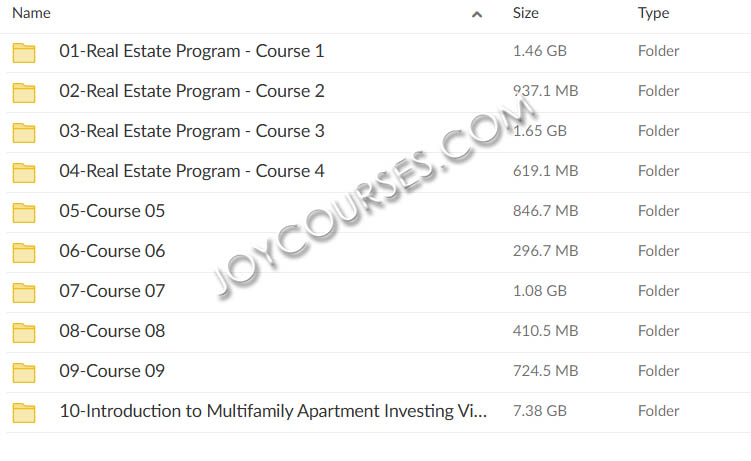

Download Proof | Grant Cardone – How to Create Wealth Investing In Real Estate

![]()

Grant Cardone – How to Create Wealth Investing in Real Estate is a comprehensive training program designed to teach individuals how to build wealth through real estate investing. Grant Cardone, a renowned entrepreneur and real estate investor, shares his strategies for acquiring and managing income-generating properties, focusing on how anyone can build a successful real estate portfolio, regardless of their starting point.

Key Concepts of How to Create Wealth Investing in Real Estate

1. Why Real Estate?

- Stability and Cash Flow: Real estate is a proven asset class that can provide long-term wealth through appreciation and, more importantly, consistent cash flow from rental income.

- Tax Benefits: Real estate investing offers tax deductions, such as depreciation, that can help investors reduce their taxable income.

- Leverage: The ability to use other people’s money (such as mortgages or loans) to invest in larger, income-producing properties.

- Wealth Building: Real estate can generate both short-term income (from rent) and long-term appreciation (from property value increases), creating substantial wealth over time.

Core Principles in the Program

1. Understanding Real Estate Fundamentals

- Types of Real Estate Investments: Cardone covers different asset types, including multifamily, commercial, and residential properties, helping investors decide where to start.

- Cash Flow vs. Appreciation: Learn how to identify properties that provide both immediate cash flow and long-term value growth.

- Risk Management: Cardone emphasizes understanding risks and how to mitigate them, especially with debt and market fluctuations.

2. Building a Real Estate Portfolio

- Starting with Small Investments: The program teaches beginners how to start with modest investments and scale over time.

- Leverage and Financing: Cardone highlights how to use leverage (such as taking out loans) to purchase properties with less of your own capital.

- Scaling Your Portfolio: Learn how to move from single-family homes or smaller multifamily properties to larger, more profitable commercial real estate deals.

3. Identifying Profitable Real Estate Deals

- Finding Deals: Discover how to find undervalued properties and lucrative deals in your local market and nationwide.

- Analyzing Property Potential: Cardone discusses how to assess properties for profitability, using metrics like cash-on-cash return, cap rates, and internal rates of return (IRR).

- Due Diligence: Tips on how to conduct thorough due diligence before committing to a deal, ensuring there are no hidden surprises.

4. Financing Your Investments

- Traditional and Non-Traditional Financing: Learn how to finance properties using banks, private lenders, or syndication.

- Creative Financing: Explore alternative ways to finance your investments, such as seller financing, hard money loans, or leveraging partnerships.

- Using Other People’s Money (OPM): Cardone explains how to raise capital from other investors to fund larger deals.

5. Building Wealth Through Syndications

- What is a Syndication?: Cardone’s strategy for raising capital from multiple investors to purchase larger commercial properties.

- How to Raise Capital: Learn how to approach investors, structure deals, and manage the expectations of your partners.

- Managing Syndicated Investments: Cardone outlines how to manage these larger investments and deliver returns to your investors.

6. Managing Your Real Estate

- Property Management: Learn how to effectively manage rental properties, reduce vacancies, and optimize rent collection.

- Hiring a Property Manager: Tips for selecting and working with property managers to handle day-to-day operations.

- Tenant Relations: Understand the importance of building good relationships with tenants to ensure retention and reduce turnover.

7. Tax Strategies and Benefits

- Depreciation and Deductions: Real estate allows investors to write off the depreciation of their properties as a tax benefit.

- 1031 Exchange: Learn about the tax-deferral strategy of exchanging one property for another, allowing you to defer capital gains taxes on profits.

- Maximizing Tax Benefits: Discover the best ways to take advantage of tax laws to minimize liabilities.

8. Creating Financial Freedom

- Building Passive Income: Cardone focuses on real estate as a vehicle for generating passive income, which can lead to financial freedom.

- Diversification: Understanding how real estate fits into a diversified investment strategy, reducing risk and increasing potential returns.

- Exit Strategies: Discusses how to exit investments profitably, whether through property sales, refinancing, or holding long-term for cash flow.

Grant Cardone’s Investment Philosophy

- Think Big: One of the key tenets of Cardone’s approach is to think big and invest in large, income-generating properties rather than starting with small residential properties.

- Massive Action: Just like his 10X Rule, Cardone emphasizes taking massive action to scale quickly and aggressively in real estate.

- Debt as a Tool: Cardone advocates using debt strategically to leverage your money and grow your wealth, rather than avoiding it.

- Focus on Cash Flow: While many investors focus on property appreciation, Cardone stresses the importance of building cash flow through rental income.

How the Program Works

- Video Lessons: The course includes video modules that cover each aspect of real estate investing, from finding deals to managing properties.

- Worksheets and Templates: Students receive worksheets to help them assess potential properties, create financial projections, and map out investment strategies.

- Grant’s Personal Insights: Throughout the course, Cardone shares his personal experiences and lessons learned, giving students real-world examples of his successes (and failures) in the industry.

- Access to Resources: Cardone provides access to exclusive resources, such as investment calculators, sample deal structures, and finance tips.

Benefits of the Program

- Proven System: Cardone shares the exact strategies he used to build a billion-dollar real estate portfolio.

- Actionable Steps: The program provides clear, step-by-step instructions to help anyone get started in real estate investing, regardless of experience level.

- Leverage Debt: Learn how to effectively use leverage to maximize returns and scale faster.

- Focus on Passive Income: Develop strategies for generating long-term passive income through rental properties and syndications.

- Comprehensive Knowledge: The course covers every aspect of real estate investing, from finding properties to financing and managing them.

Who Should Take the Course?

- Beginners: Those who want to learn about real estate investing but have little to no experience.

- Aspiring Investors: Anyone looking to grow their wealth through real estate, especially through large-scale, income-generating properties.

- Experienced Investors: Those who want to refine their strategies, learn about syndications, or expand their portfolios.

- Entrepreneurs: Business owners interested in adding real estate as an investment strategy for wealth creation.

Conclusion

Grant Cardone – How to Create Wealth Investing in Real Estate offers a comprehensive and actionable roadmap for those looking to build significant wealth through real estate investing. By focusing on cash flow, leverage, and massive action, Cardone provides students with the tools and mindset needed to succeed in real estate, from small deals to large syndications.