Description

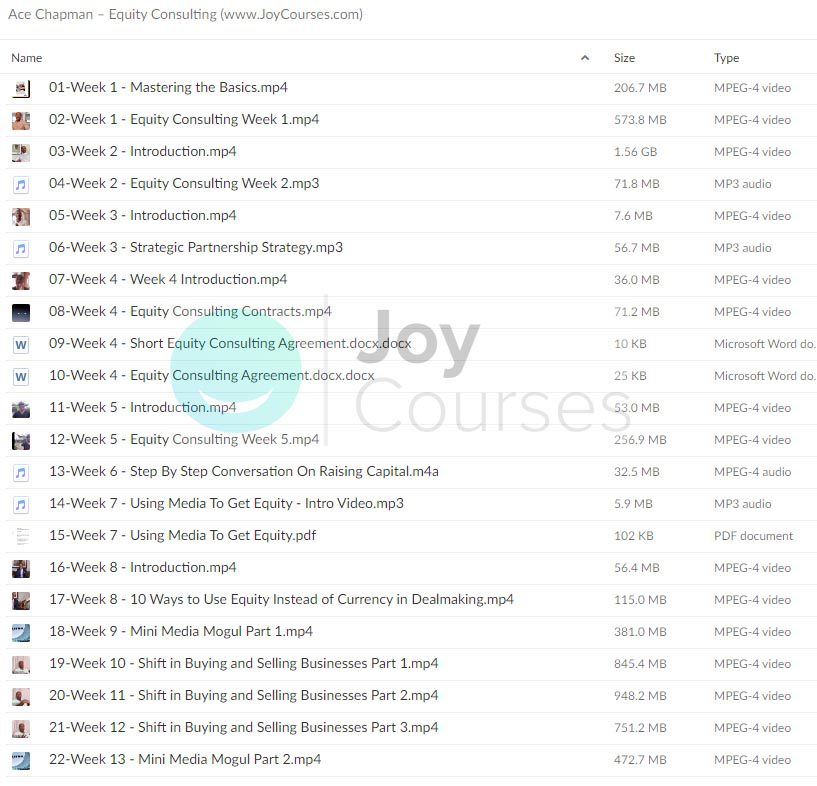

Download Proof | Ace Chapman – Equity Consulting (6.39 GB)

![]()

Ace Chapman – Equity Consulting Course

Introduction Ace Chapman’s Equity Consulting Course is designed to provide a comprehensive learning experience for anyone looking to excel in the field of equity consulting. This program covers essential topics such as sourcing deals, negotiating terms, structuring financing, and implementing growth strategies, offering valuable insights to both beginners and seasoned professionals.

Course Overview

1. Identifying Opportunities

The course begins by teaching participants how to identify lucrative opportunities that align with their expertise. You’ll learn to assess key factors like industry size and competition, as well as how to establish a legal entity. This initial phase helps set the foundation for building a successful equity consulting business.

2. Sourcing and Evaluation

Participants are guided through the process of building a deal pipeline, covering multiple sourcing techniques. You’ll discover how to evaluate potential deals by examining financial indicators and market conditions. The course focuses on the skills needed to select deals that offer the highest potential returns.

3. Negotiation and Due Diligence

Ace Chapman emphasizes mastering negotiation strategies and conducting thorough due diligence. The course includes real-world case studies, along with templates for legal agreements and checklists that help you navigate the complexities of negotiation and evaluate equity deals with precision.

4. Financing and Completion

Understanding how to finance and complete deals is crucial. This section covers various financing structures, tax strategies, and methods for asset transfers. You’ll also learn investor management techniques that help maximize returns while securing optimal funding for your ventures.

5. Growth and Expansion

Once a deal is closed, the focus shifts to operating and growing your equity portfolio. The course teaches you how to create go-to-market strategies, identify growth opportunities, and reinvest profits to foster sustained business growth. Protecting intellectual property and managing risk are also covered.

6. Exit Strategies

One of the final steps in equity consulting is developing a solid exit strategy. Ace Chapman explains how to increase the intrinsic value of your business, streamline operations, and position your equity holdings for a profitable sale. You’ll learn strategies for optimizing returns when exiting investments.

Key Learning Points

- Sourcing and Obtaining Equity: Master the process of identifying ideal opportunities and securing equity. The course provides in-depth guidance on sourcing deals, building deal flow, and optimizing your consulting approach to acquire equity.

- Negotiation and Legal Tools: Learn essential negotiation tactics backed by legal templates and email scripts to help you secure the best terms. Ace Chapman’s real-world insights make this process actionable and practical.

- Contributing to Growth: After securing equity, the focus turns to growth strategies. Participants are guided through creating a detailed 100-day marketing plan to drive immediate results and long-term success.

Conclusion

Ace Chapman’s Equity Consulting Course delivers an in-depth approach to mastering the art of equity consulting, from sourcing and negotiation to financing and scaling. With real-world insights, templates, and practical strategies, this course is ideal for those looking to build or enhance their career in equity consulting.

By enrolling, you will gain the tools and confidence needed to navigate the complexities of the equity consulting industry, helping you make informed decisions that drive substantial growth.

Whether you’re just starting or looking to advance your career, this course provides the framework for long-term success in equity consulting.