Description

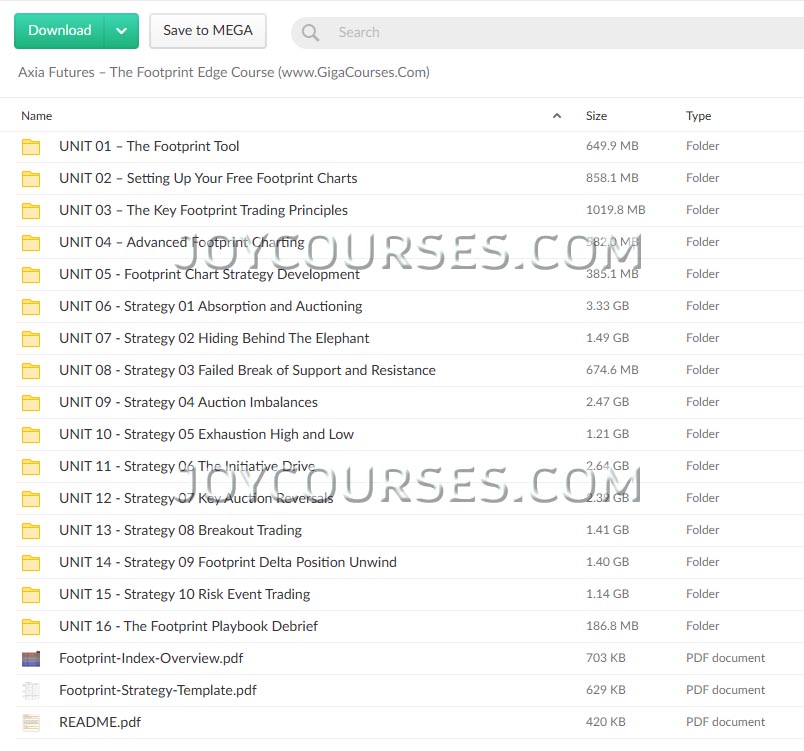

Download Proof | Axia Futures – The Footprint Edge Course (21.73 GB)

![]()

The “Footprint Edge” course by Axia Futures is aimed at traders looking to develop advanced skills in reading and interpreting market data through order flow. The course likely focuses on using footprint charts, which visually represent volume traded at each price level during a specific period. This type of analysis helps traders see where larger trades are occurring, providing insight into potential support and resistance levels, order absorption, and momentum shifts. Here are some core aspects the course likely covers:

- Understanding Footprint Charts: Teaching how to interpret the data, including volume at bid and ask levels, traded volume, and delta (difference between buying and selling).

- Order Flow Analysis: Learning to recognize patterns in order flow, identifying high-volume nodes, and how they can inform entry and exit points.

- Real-Time Market Interpretation: Leveraging footprint charts to make quick, real-time trading decisions, understanding liquidity and supply/demand in the market.

- Building a Trading Strategy: Using footprint data to establish systematic trading approaches, targeting specific chart patterns and behavioral cues.

- Risk Management: Developing disciplined risk management techniques to handle trade setups derived from footprint charts effectively.

- Practical Exercises: Live trading examples, case studies, and exercises to reinforce learning and provide hands-on experience.