Description

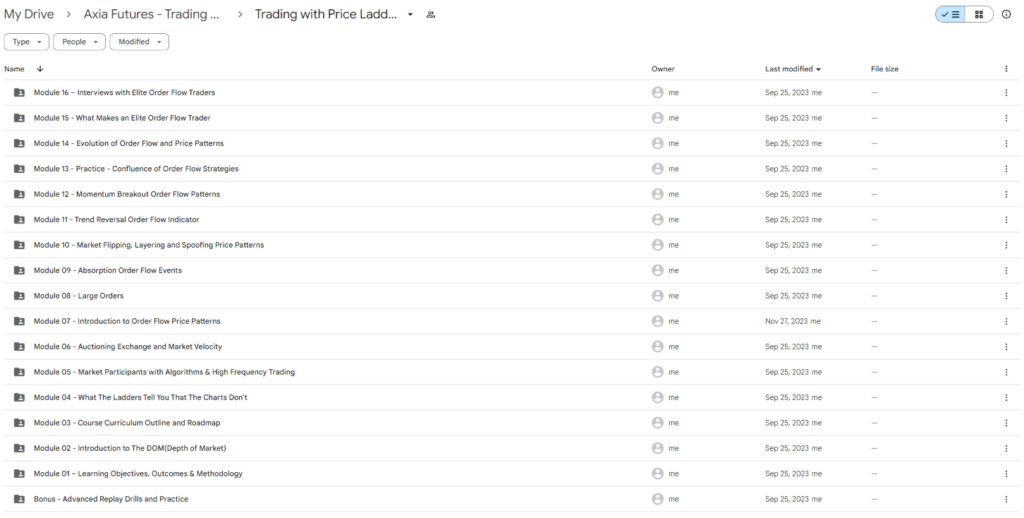

Download proof | Axia Futures – Trading with Price Ladder and Order Flow Strategies (12.3 GB)

![]()

Axia Futures – Trading with Price Ladder and Order Flow Strategies is a specialized training program designed for traders who want to deepen their understanding of market dynamics using price ladder analysis and order flow techniques. This program typically focuses on developing practical skills for analyzing market data and making informed trading decisions based on real-time order flow. Here’s an overview of what the program usually includes:

1. Introduction to Order Flow Trading

- What is Order Flow Trading?: An overview of order flow trading and its importance in understanding market dynamics.

- Understanding the Market Structure: Learning how market participants (e.g., retail traders, institutions) influence price movements and liquidity.

2. The Price Ladder Explained

- Understanding the Price Ladder: Introduction to the price ladder (or depth of market) and its components, including bids, asks, and market orders.

- Reading the Price Ladder: Techniques for interpreting the information presented in the price ladder to gauge market sentiment and potential price movement.

- Identifying Support and Resistance: How to use the price ladder to identify key support and resistance levels based on order flow.

3. Analyzing Order Flow

- Order Types: Understanding different order types (e.g., market orders, limit orders) and their implications for trading strategies.

- Order Flow Analysis Techniques: Learning how to analyze order flow data, including volume, price changes, and trade execution.

- Identifying Imbalances: Techniques for spotting order imbalances that may indicate potential reversals or continuations in price movement.

4. Developing Trading Strategies

- Creating a Trading Plan: Guidance on developing a comprehensive trading plan that incorporates price ladder and order flow strategies.

- Strategy Implementation: Practical strategies for executing trades based on order flow signals and price ladder insights.

- Combining Technical Analysis: How to integrate order flow analysis with traditional technical analysis for a well-rounded approach.

5. Risk Management in Order Flow Trading

- Understanding Risk: Exploring the specific risks associated with order flow trading and strategies to mitigate them.

- Setting Stop-Loss and Take-Profit Levels: Techniques for determining optimal stop-loss and take-profit levels based on order flow dynamics.

- Position Sizing: Learning how to calculate position sizes effectively to manage risk and maximize potential returns.

6. Live Trading and Simulations

- Practical Trading Sessions: Opportunities to participate in live trading sessions or simulations to practice order flow and price ladder strategies.

- Real-Time Analysis: Gaining experience in analyzing order flow and price movements in real-time market conditions.

- Feedback and Coaching: Access to personalized feedback and coaching from experienced traders during live trading sessions.

7. Psychology of Trading

- Managing Emotions: Understanding the psychological aspects of trading and how they impact decision-making.

- Building Discipline: Techniques for maintaining discipline and sticking to your trading plan amidst market fluctuations.

- Overcoming Psychological Barriers: Strategies for overcoming common psychological barriers that traders face.

8. Tools and Resources

- Trading Platforms: Introduction to trading platforms and software that support order flow and price ladder analysis.

- Data Sources: Identifying reliable data sources for market information and order flow data.

- Continuing Education: Providing resources for ongoing learning, including books, articles, and online communities.

9. Community and Networking

- Access to a Trading Community: Connecting with fellow participants for networking and sharing insights.

- Resource Sharing: Opportunities to share tools, techniques, and experiences with other traders.

- Support Network: Building a support network for ongoing encouragement and collaboration.

Axia Futures – Trading with Price Ladder and Order Flow Strategies aims to equip traders with the skills and knowledge necessary to effectively analyze market data and execute trades based on order flow insights. By focusing on practical strategies and real-time analysis, participants can enhance their trading performance and make informed decisions in the fast-paced futures market.