Description

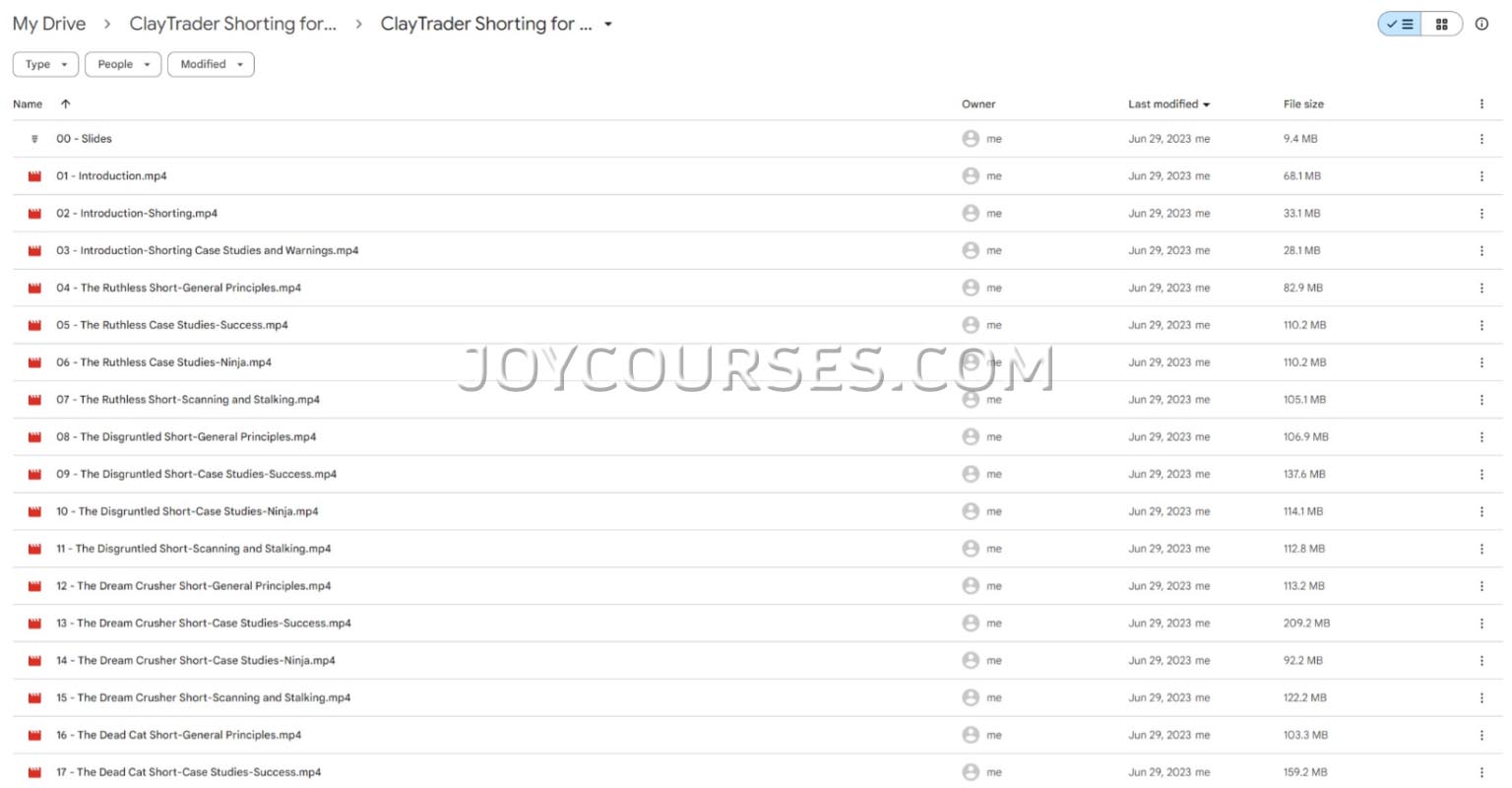

Download proof | ClayTrader – Shorting for Profit (Course Size: 2.50 GB)

![]()

ClayTrader’s “Shorting for Profit” course is focused on teaching traders how to profit from declining markets by taking short positions. Short selling, or shorting, involves betting against a stock or asset by selling it first with the goal of buying it back at a lower price, thus capturing the difference as profit. ClayTrader designed this course for traders who want to expand their skill set beyond traditional buying, teaching both technical and strategic aspects of short selling in various market conditions.

Here’s a breakdown of what the course typically covers:

1. Introduction to Short Selling

- What is Short Selling?: The basics of short selling, how it works, and how it differs from traditional buying or “going long.”

- When to Short: Understanding scenarios where shorting is appropriate, such as during market downtrends, corrections, or asset-specific declines.

- Risks and Rewards of Short Selling: An in-depth look at the potential rewards as well as the unique risks involved in shorting, including unlimited risk and short squeezes.

2. Market Mechanics and Technical Aspects of Short Selling

- Borrowing Shares to Short: The mechanics of borrowing shares, how short interest impacts availability, and understanding “locate fees” for shortable shares.

- Order Types for Shorting: Key order types for short selling, including market, limit, and stop-loss orders, tailored to short positions.

- Broker Requirements for Shorting: Overview of margin requirements, broker-specific rules, and the capital needed to maintain short positions.

3. Finding Short Opportunities

- Identifying Weak Stocks: Methods for spotting stocks that are showing signs of weakness, including technical indicators and market sentiment.

- Using Technical Analysis for Shorting: Key chart patterns that signal potential declines, such as head and shoulders, double tops, and breakdowns from support levels.

- Fundamental Triggers for Short Selling: How to spot overvalued stocks, red flags in earnings reports, or company-specific news that could lead to declines.

4. Strategies for Profiting from Downtrends

- Momentum-Based Short Selling: Shorting stocks that have sharp downward momentum, often due to negative news or earnings misses.

- Reversal and Breakdown Patterns: Recognizing chart patterns that indicate a reversal in trend, allowing for precise short entry points.

- Shorting Overextended Moves: Techniques for shorting stocks that have experienced sharp, unsustainable upward moves and may be due for a pullback.

5. Risk Management in Short Selling

- Setting Stop-Losses for Shorts: Determining appropriate stop-loss levels to manage risk on short positions and avoid unlimited losses.

- Position Sizing and Leverage: Guidelines for sizing short positions, with a focus on managing exposure given the higher risk involved.

- Avoiding Short Squeezes: Understanding and identifying potential short-squeeze setups to avoid getting caught in rapid, unexpected upward moves.

6. Shorting in Different Market Conditions

- Bear Markets and Downtrends: How to identify and capitalize on market-wide downtrends, which typically provide more opportunities for shorting.

- Shorting in Range-Bound Markets: Shorting strategies for markets that are consolidating, with a focus on trading within ranges and at resistance levels.

- Volatility and Liquidity Considerations: Choosing stocks that offer adequate liquidity for shorting and adjusting strategies to match market volatility.

7. Advanced Shorting Techniques

- Gap and Fade Strategy: Shorting stocks that experience early morning gaps up but lack momentum to sustain those levels.

- Using Indicators to Confirm Shorts: Leveraging indicators such as RSI, MACD, and volume for added confirmation when entering a short position.

- Shorting with Options: Exploring put options as an alternative to shorting shares, especially for limiting risk and using leverage.

8. Execution and Trade Management

- Timing Short Entries: Tips on when to enter short positions and techniques for avoiding “early entry” on short trades.

- Managing Open Short Positions: How to handle winning trades, when to take partial profits, and when to cover the full position.

- Exit Strategies for Short Selling: Setting realistic profit targets and using technical signals to decide when to close short positions.

9. Psychology of Short Selling

- Mindset for Short Sellers: Developing a mindset for shorting, which often runs counter to traditional “bullish” trading.

- Handling Market Bias: How to recognize and set aside any personal bias toward bullish markets to see shorting opportunities objectively.

- Discipline in Downtrends: Techniques for staying disciplined and avoiding impulsive trades, especially when markets are highly volatile.

ClayTrader’s “Shorting for Profit” course provides traders with a comprehensive approach to short selling, covering everything from identifying setups to managing trades in declining markets. The course is ideal for traders who want to diversify their strategies and learn to capitalize on bearish market moves or corrections, whether they’re experienced or just beginning with short positions.