Description

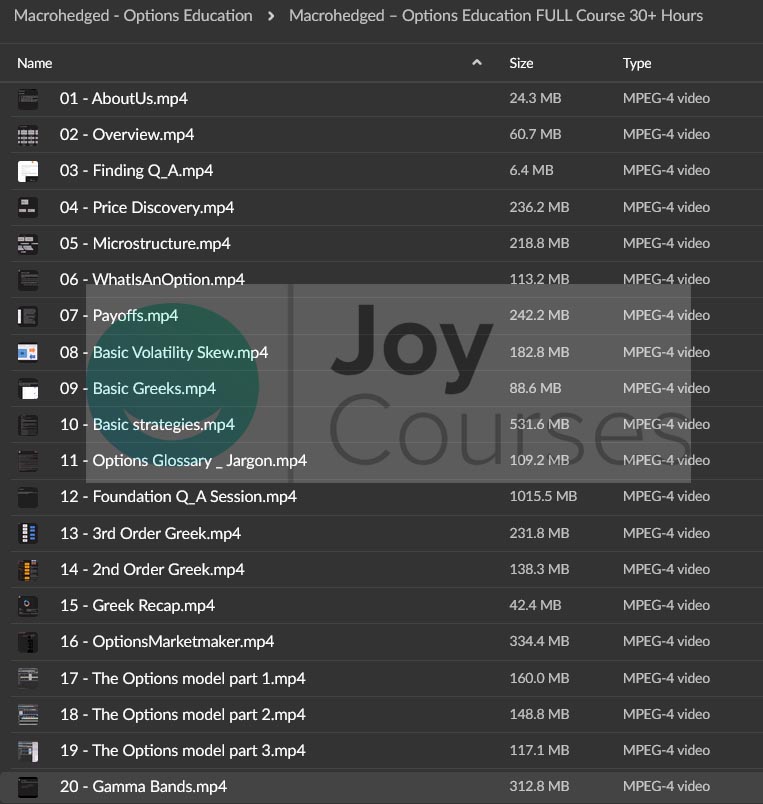

Macrohedged – Options Education

![]()

Macrohedged offers a platform focused on options trading and related education, catering to traders interested in understanding derivatives markets, risk management, and advanced trading strategies. Whether you’re new to options or an experienced trader looking for specialized strategies, Macrohedged likely covers topics such as:

Key Features of Macrohedged’s Options Education:

- Options Basics:

- Understanding calls and puts.

- Mechanics of options pricing (e.g., intrinsic value, time value).

- Key terms like Delta, Gamma, Vega, and Theta (the “Greeks”).

- Advanced Strategies:

- Spreads (e.g., vertical, horizontal, and diagonal spreads).

- Hedging techniques using options.

- Volatility-based trading strategies.

- Market Analysis and Risk Management:

- Using macroeconomic factors to influence options trades.

- Position sizing and portfolio diversification.

- Tail risk hedging and managing implied volatility.

- Technology and Tools:

- Algorithmic trading and quant-based approaches.

- Using tools for options valuation and market simulation.

- Live Market Applications:

- Analyzing real-world examples of trades.

- Case studies on how traders manage risks and profits in varying market conditions.

Would you like help diving into any specific aspect of options trading or accessing Macrohedged’s resources?

Options Education course by Macrohedged buy

Options Education by Macrohedged buy

Options Education course by Macrohedged buy

Options Education by Macrohedged Course buy

Options Education by Macrohedged Course buy online

Buy Options Education by Macrohedged

Macrohedged – Options Education download

Buy Options Education by Macrohedged Course

Options Education by Macrohedged cheap price

Options Education – Macrohedged buy

Options Education by Macrohedged Download

Options Education – Macrohedged Course buy

Options Education – Macrohedged Course buy online

Buy Options Education – Macrohedged

Buy Options Education – Macrohedged Course

Options Education – Macrohedged buy cheap price

Macrohedged – Options Education course download

Macrohedged – Options Education download

Options Education by Macrohedged course download

Options Education by Macrohedged download