Price Action Volume Trader – Trading with Market and Volume Profile

The Price Action Volume Trader course focuses on advanced trading techniques, particularly utilizing price action and volume profile to trade financial markets effectively. This approach helps traders make more informed decisions by combining market price movements with volume analysis to understand market sentiment, identify key support and resistance levels, and improve entry and exit strategies.

Course Overview:

The course teaches a robust method for analyzing price action alongside volume profiles, a technique that is invaluable for traders seeking to capture high-probability trade setups. By learning these combined strategies, traders can understand market dynamics more deeply, helping them anticipate price movements and identify market trends with greater accuracy.

Key Features of the Course:

-

Understanding Price Action:

- Learn how to read candlestick patterns and price movements without relying on indicators.

- Focus on support and resistance zones, trendlines, and market structure to make better trading decisions.

- Develop a comprehensive understanding of how price reacts to specific levels of interest in the market.

-

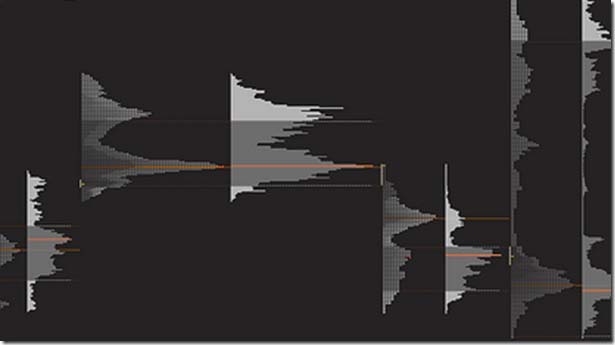

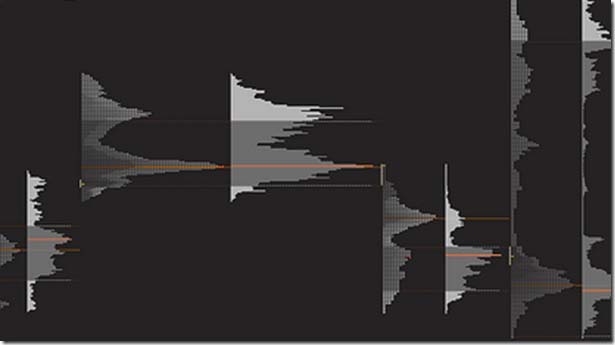

Market Profile Analysis:

- Gain an in-depth understanding of market profile, which provides insights into market behavior by displaying the distribution of price over time.

- Learn to read the profile chart, including the value area, point of control (POC), and other key components.

- Use the market profile to identify trends, volume spikes, and significant price levels that are pivotal for making trading decisions.

-

Volume Profile Trading:

- Understand how volume at specific price levels plays a crucial role in price discovery.

- Learn how to spot areas of high and low volume to predict future price movements.

- Master volume profile patterns like high volume nodes (HVNs) and low volume nodes (LVNs) to find potential entry and exit points.

-

Combining Price Action with Volume Profile:

- Learn how to combine price action with volume profile to spot more precise entry and exit points.

- Identify key areas of support and resistance based on both price and volume information.

- Develop a trading plan using these tools to manage risk, improve trade accuracy, and increase win rates.

-

Advanced Trade Setups:

- Learn advanced strategies using price action and volume profile to spot high-probability setups.

- Understand how to set stop losses and profit targets based on the volume profile analysis.

- Explore techniques to trade different market conditions, whether trending or in consolidation.

-

Risk Management and Trade Psychology:

- Learn strategies to manage risk effectively, including position sizing and stop placement.

- Develop a disciplined approach to trading, managing emotions, and sticking to your strategy.

- Understand the psychological aspect of trading and how to build confidence in your decisions.

-

Practical Examples and Case Studies:

- Watch real-world examples and case studies where these techniques are applied in live markets.

- Learn from live market analysis to better understand how to apply the concepts in your own trading.

- Use demo accounts or paper trading to practice what you learn before applying it to real markets.

Who Should Take This Course?

- Intermediate to Advanced Traders: The course is ideal for traders who already have a basic understanding of trading and want to refine their skills using advanced techniques like price action and volume profile.

- Price Action Traders: Traders looking to expand their current strategy by integrating volume analysis to enhance their decision-making process.

- Day Traders and Swing Traders: Both day traders and swing traders can benefit from this approach, as it provides insight into both short-term and medium-term price movements.

- Traders Seeking More Precision: If you’re tired of relying on traditional indicators and are looking for a more effective way to analyze market movements, this course will provide you with tools for making better-informed decisions.

Course Format:

- Duration: The course can typically be completed at your own pace, with video lessons, demonstrations, and supplementary materials.

- Delivery Method: The course is available online, allowing you to access the content anytime, anywhere.

- Pricing: Specific pricing details for the course are available on the course website, but it is usually offered as a one-time payment for lifetime access to the content and resources.

Benefits of the Course:

- Increased Trade Accuracy: Learn to analyze price movements and volume data to find precise entry and exit points.

- Better Market Understanding: Gain insights into market behavior, helping you anticipate trends and avoid false breakouts.

- Develop Confidence: Master tools that will boost your confidence when entering and exiting trades, reducing indecision and uncertainty.

- Improved Risk Management: Use the strategies to manage risk more effectively, ensuring you can trade with a plan.

- Higher Win Rates: By focusing on high-probability setups with clear entry and exit signals, traders can improve their chances of success.

Accessing the Course:

To learn more about the Price Action Volume Trader course, or to enroll, visit the official course website, where you can find more details about the curriculum, pricing, and any potential promotional offers.

This course is ideal for traders who want to take their trading to the next level by using advanced tools to decode market behavior and create profitable strategies. Whether you’re a seasoned trader or someone looking to step up your trading game, the Price Action Volume Trader course provides valuable insights and strategies that can enhance your success in the financial markets.

![]()