Description

Retail Capital – My Trading Framework

![]()

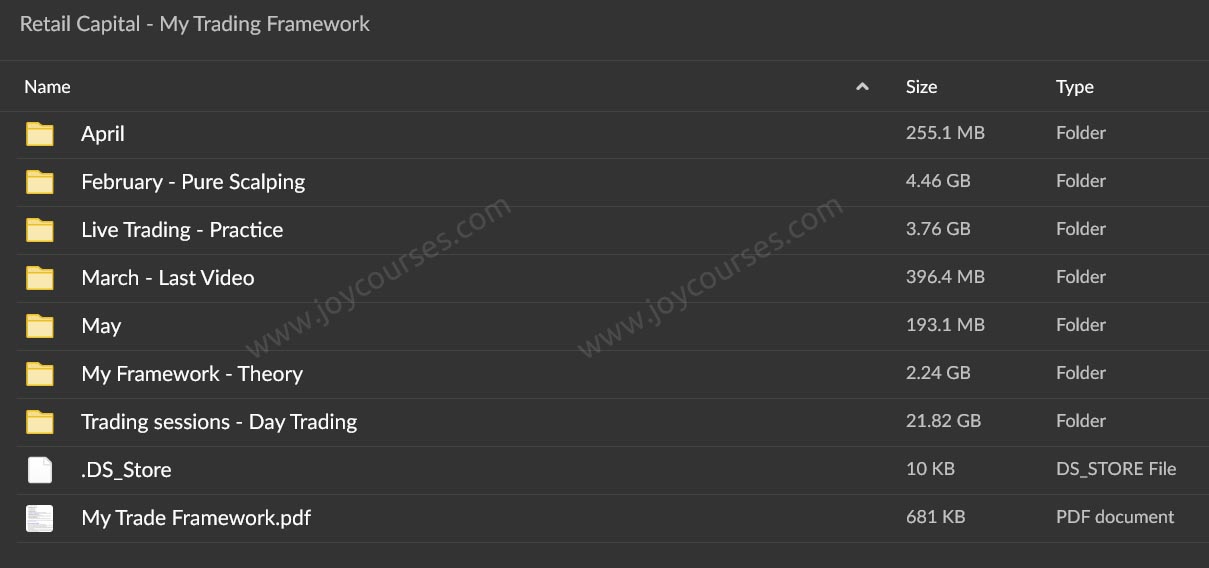

“Retail Capital – My Trading Framework” likely refers to a structured approach tailored to retail traders for navigating the financial markets. Such frameworks are often designed to simplify complex concepts, align trading practices with individual goals, and emphasize risk management, particularly for traders with limited capital.

Here’s an outline of what such a trading framework might include:

1. Foundational Concepts

- Market Understanding: Basics of asset classes (stocks, options, forex, futures) and how they interact.

- Retail Edge: Leveraging advantages like flexibility, speed of decision-making, and smaller position sizes compared to institutions.

- Trading Goals: Clarifying objectives—income, capital growth, or hedging.

2. Trading Strategies

- Trend Following: Identifying and trading with prevailing market trends.

- Mean Reversion: Recognizing when markets may return to historical averages.

- Breakout Trading: Capturing momentum by trading on price movements beyond key levels.

- Options and Leverage: Incorporating derivatives for efficiency while managing risks.

3. Risk Management

- Position Sizing: Using fixed percentages of capital per trade to prevent overexposure.

- Stop-Losses and Take-Profits: Defining levels to limit losses and lock in gains.

- Diversification: Avoiding concentrated exposure to any single asset or market.

4. Tools and Indicators

- Technical Analysis: Utilizing moving averages, RSI, MACD, and other indicators.

- Fundamental Analysis: Assessing economic reports, earnings, and geopolitical events.

- Data-Driven Insights: Incorporating historical data and probabilities to shape trades.

5. Psychology and Discipline

- Mindset: Developing patience, managing fear, and avoiding greed.

- Journaling: Keeping a detailed log of trades for continuous learning.

- Adaptability: Revising the framework based on changing market conditions.

6. Framework Customization

- Aligning with the trader’s financial situation, time availability, and market preferences.

- Iterative improvements based on performance metrics.

Would you like assistance in developing or refining a trading framework, or are you looking for specific tools and strategies?