Description

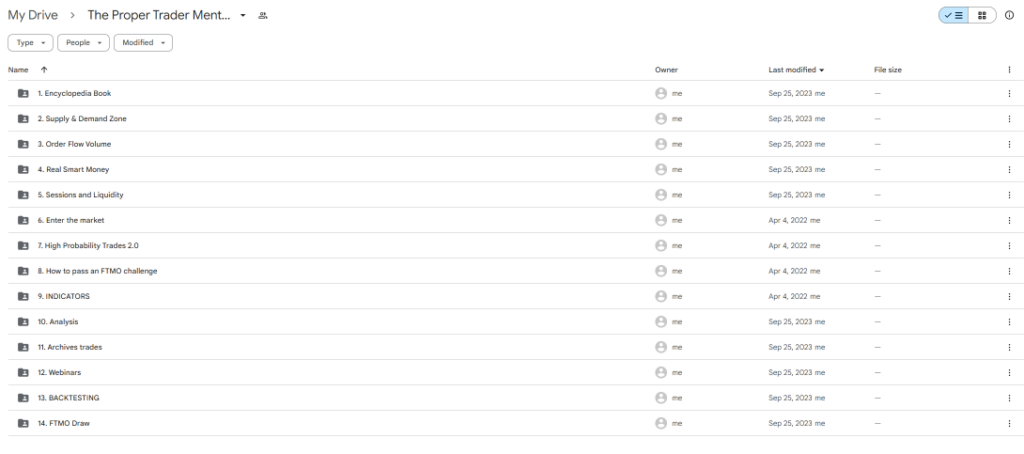

Download proof | The Proper Trader Mentorship (2.31 GB)

![]()

The Proper Trader Mentorship is a comprehensive training and mentorship program designed for individuals looking to enhance their trading skills and develop a disciplined trading approach. This program typically focuses on fostering a strong trading mindset, teaching effective strategies, and providing personalized guidance to help traders succeed in various markets, including stocks, forex, and cryptocurrencies. Here’s an overview of what the program usually includes:

1. Foundations of Trading

- Understanding Market Mechanics: An introduction to how financial markets operate, including key concepts like liquidity, volatility, and market participants.

- Market Types: Exploring different market types (stocks, options, futures, forex, etc.) and understanding their characteristics and trading opportunities.

2. Developing a Trading Plan

- Creating a Personalized Trading Plan: Guidance on developing a comprehensive trading plan that outlines goals, strategies, and risk management techniques.

- Goal Setting: Techniques for setting realistic and measurable trading goals that align with individual aspirations.

- Trading Style Identification: Helping traders identify their preferred trading style (day trading, swing trading, long-term investing) based on personality and lifestyle.

3. Technical and Fundamental Analysis

- Technical Analysis Fundamentals: Introduction to chart patterns, indicators, and technical analysis tools used to analyze price movements.

- Fundamental Analysis: Understanding how economic indicators, company performance, and market news impact price movements.

- Combining Analyses: Strategies for integrating technical and fundamental analysis to make informed trading decisions.

4. Risk Management Strategies

- Understanding Risk: Exploring the importance of risk management in trading and how to identify potential risks.

- Setting Stop-Loss and Take-Profit Levels: Techniques for determining optimal stop-loss and take-profit levels to protect capital and lock in profits.

- Position Sizing: Learning how to calculate appropriate position sizes based on account size, risk tolerance, and trade setups.

5. Trading Psychology

- Emotional Discipline: Understanding the psychological aspects of trading and their impact on decision-making.

- Building a Trader’s Mindset: Techniques for cultivating a disciplined and resilient mindset to navigate the challenges of trading.

- Overcoming Psychological Barriers: Strategies for managing fear, greed, and other emotions that can hinder trading performance.

6. Mentorship and Personalized Guidance

- One-on-One Mentorship: Providing personalized coaching sessions to address individual challenges and goals.

- Feedback on Trade Performance: Analyzing past trades to identify strengths, weaknesses, and areas for improvement.

- Continuous Support: Offering ongoing support and guidance as traders progress through their learning journey.

7. Live Trading Sessions

- Real-Time Trading Experience: Opportunities to participate in live trading sessions to apply learned strategies and concepts in real market conditions.

- Analysis and Discussion: Engaging in discussions about market movements, trade setups, and decision-making processes during live sessions.

- Learning from Real Trades: Analyzing the outcomes of live trades to understand what worked, what didn’t, and why.

8. Building a Trading Community

- Networking Opportunities: Connecting with fellow traders to share experiences, strategies, and insights.

- Access to Resources: Providing access to tools, templates, and resources to enhance trading skills.

- Collaboration and Support: Encouraging collaboration among participants to foster a supportive learning environment.

9. Ongoing Learning and Development

- Continuous Improvement: Emphasizing the importance of ongoing education and adaptation in trading strategies.

- Staying Current: Encouraging traders to stay updated on market trends, news, and changes in trading regulations.

- Goal Reevaluation: Regularly revisiting and adjusting trading goals and plans as traders gain experience.

The Proper Trader Mentorship aims to equip participants with the necessary skills, knowledge, and support to become successful and disciplined traders. By focusing on a holistic approach that combines strategy, psychology, and mentorship, traders can build a strong foundation for long-term success in the financial markets.