Description

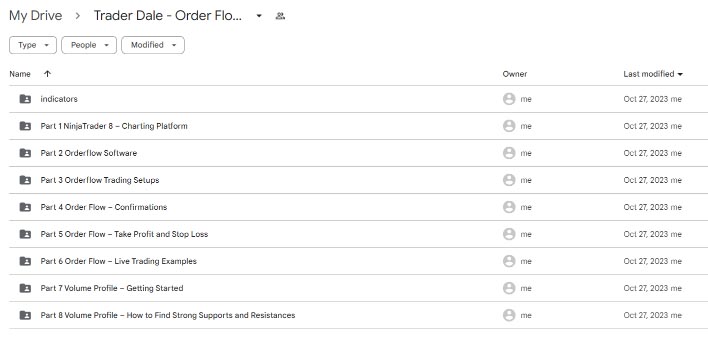

Download Proof | Trader Dale – Order Flow Course (5.74 GB)

![]()

Trader Dale – Order Flow Course is a comprehensive training program designed to teach traders how to analyze market order flow to make informed trading decisions. This course focuses on understanding the underlying dynamics of market movements by interpreting the flow of buy and sell orders.

Key Features of the Order Flow Course:

- Introduction to Order Flow Trading:

- The course begins with a solid foundation in order flow trading, explaining its significance in understanding market dynamics.

- Participants learn the basics of how order flow influences price movements, providing a context for advanced trading strategies.

- Market Structure and Order Flow Analysis:

- Detailed lessons on reading and interpreting market structure in conjunction with order flow data.

- Emphasis on key concepts such as support and resistance levels, trend identification, and market phases (trending vs. ranging).

- Understanding Order Types:

- An exploration of different types of market orders, including market orders, limit orders, stop orders, and how they affect price movement.

- Participants learn how to differentiate between retail and institutional trading activities and the implications for order flow.

- Using Order Flow Tools:

- Instruction on utilizing specific tools and platforms designed for order flow analysis, such as footprint charts, volume profiles, and delta indicators.

- Participants gain hands-on experience in setting up and using these tools to identify trading opportunities.

- Practical Trading Strategies:

- The course covers a range of practical trading strategies based on order flow analysis, focusing on how to enter and exit trades effectively.

- Strategies include identifying high-probability setups, managing risk, and optimizing trade execution based on order flow signals.

- Live Trading Sessions:

- Opportunities for participants to observe live trading sessions where Trader Dale demonstrates order flow trading in real-time.

- These sessions provide practical insights and enhance the learning experience by showcasing how to apply theoretical knowledge in actual market conditions.

- Risk Management Techniques:

- Comprehensive guidance on implementing effective risk management strategies in order flow trading to protect capital and maximize profits.

- Techniques include position sizing, setting stop-loss orders, and understanding drawdown management.

- Psychological Aspects of Trading:

- The course also addresses the psychological factors that influence trading decisions, helping participants develop the right mindset for success.

- Emphasis on maintaining discipline and managing emotions while trading based on order flow analysis.

- Community and Ongoing Support:

- Enrollment may include access to a community of traders for networking and support.

- Participants can share experiences, ask questions, and receive feedback from fellow traders and Trader Dale.

Who This Course Is For:

- Aspiring Traders who want to deepen their understanding of market dynamics and order flow analysis.

- Experienced Traders looking to enhance their trading strategies by incorporating order flow techniques.

- Day Traders and Swing Traders interested in short-term and medium-term trading strategies based on order flow.

- Anyone looking to develop a more systematic and data-driven approach to trading.

Key Takeaways:

- Master the art of order flow analysis and its application in trading decisions.

- Learn how to effectively read and interpret market structure and order types.

- Develop practical trading strategies that leverage order flow data for higher probability trades.

- Gain insights through live trading sessions and real-world examples.

- Build a community network for ongoing support and collaboration in trading.

The Trader Dale – Order Flow Course is designed to equip participants with the knowledge, skills, and tools needed to successfully trade using order flow analysis, ultimately enhancing their trading performance and profitability.