Description

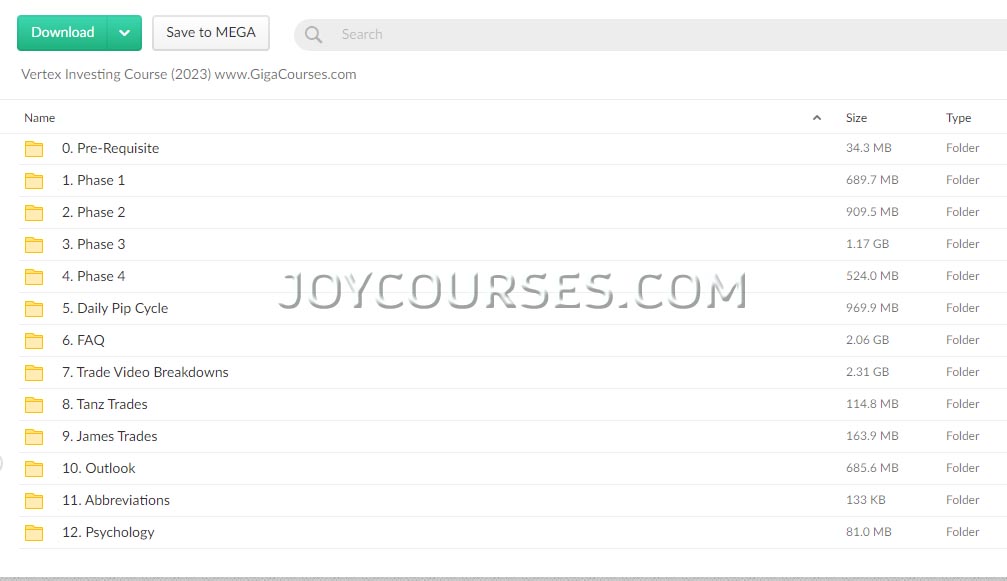

Download Proof | Vertex Investing Course (2023) (9.62 GB)

![]()

The Vertex Investing Course (2023) is designed for individuals looking to build a foundational and practical understanding of investing across different asset classes, including stocks, ETFs, crypto, and more. This course likely emphasizes modern, data-driven strategies for personal portfolio management, risk mitigation, and long-term wealth building. Here’s what the curriculum may include:

1. Introduction to Financial Markets

- Basics of different asset classes, including equities, bonds, cryptocurrencies, and alternative investments.

- Understanding market dynamics, including supply and demand, market cycles, and economic indicators.

2. Investment Strategies and Styles

- Analyzing different investment approaches, such as growth investing, value investing, dividend investing, and index investing.

- Portfolio diversification and balancing strategies to optimize risk vs. reward.

3. Technical and Fundamental Analysis

- Fundamental analysis: Evaluating financial statements, company earnings, industry trends, and economic factors.

- Technical analysis: Reading price charts, identifying trends, and using indicators (moving averages, RSI, MACD) to make informed entry and exit decisions.

4. Risk Management and Behavioral Finance

- Techniques to manage risk, including stop-loss orders, portfolio rebalancing, and hedging.

- Understanding the psychology behind investment decisions to avoid common cognitive biases, like FOMO or panic selling.

5. Crypto and Emerging Asset Classes

- Basics of cryptocurrency investment, blockchain technology, and evaluating projects.

- How to assess new asset classes for long-term viability and risk factors.

6. Creating and Managing a Personal Investment Portfolio

- Building a diversified portfolio tailored to individual goals and risk tolerance.

- Tracking and adjusting the portfolio based on changing economic conditions, personal goals, and market movements.

7. Case Studies and Real-Life Applications

- Examining successful and failed investment cases to apply learned principles.

- Practical exercises to reinforce strategies for handling real market scenarios.

8. Advanced Topics and Future Trends

- Understanding the impact of macroeconomic trends, geopolitics, and technology on the investment landscape.

- Exposure to sustainable investing (ESG) and other emerging trends shaping the future of investing.

The course is structured to take participants from foundational knowledge to a point where they can independently make informed investment decisions. Let me know if you’d like to go deeper into any section or have specific questions!