Description

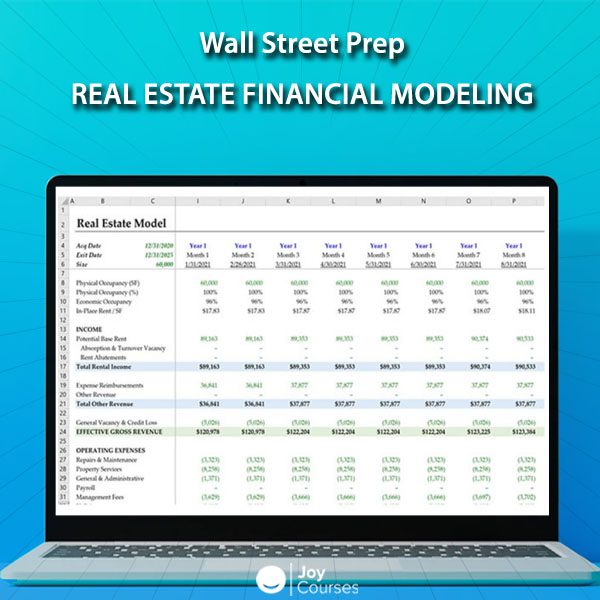

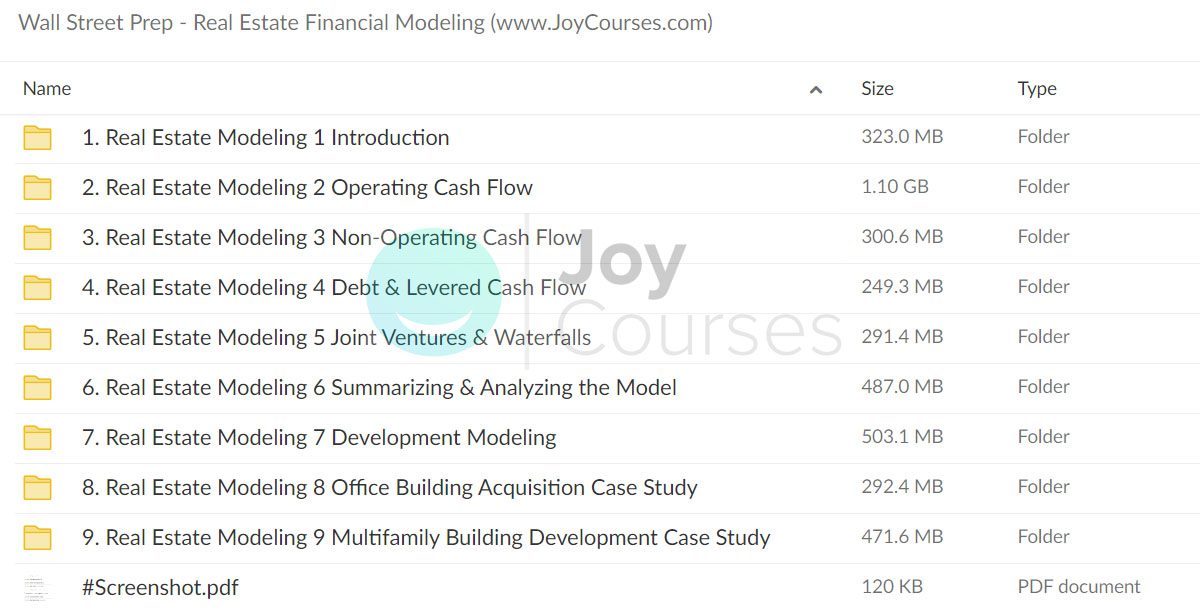

Download Proof | Wall Street Prep – Real Estate Financial Modeling (3.95 GB)

![]()

Wall Street Prep – Real Estate Financial Modeling Course

The Wall Street Prep – Real Estate Financial Modeling Course is a specialized program tailored for professionals looking to master financial modeling for Real Estate Investment Trusts (REITs). With hands-on learning and practical applications, it equips participants with the skills to build, analyze, and interpret REIT financial models, offering a comprehensive toolkit for investment banking, equity research, and real estate finance professionals.

Why Choose Wall Street Prep’s Real Estate Financial Modeling Course?

1. Real-World Application Focus:

- This course centers on practical learning through detailed case studies, like BRE Properties, where participants build and refine REIT models from the ground up.

2. Expert Instruction:

- Led by seasoned industry professionals, the course covers the nuances of the REIT sector, helping participants understand its unique drivers and challenges.

3. Comprehensive Content:

- From foundational concepts to advanced valuation methods, the course offers everything needed to excel in real estate finance, focusing on the structure, valuation, and profitability of REITs.

Key Learning Objectives

1. Deep Dive into REIT Structures:

- Participants will gain a clear understanding of the tax advantages and structural complexities of UPREITs and DOWNREITs, crucial for building accurate financial models.

2. Industry Dynamics:

- The course explains the economic cycles, regulatory frameworks, and market demand factors that influence REITs, preparing participants to adjust their models based on market changes.

3. Hands-On Learning:

- The course uses a step-by-step model-building approach, covering same-store properties, acquisitions, developments, and dispositions. This ensures participants are prepared for real-world scenarios.

Practical Modeling Skills Developed

1. Financial Model Construction:

- Participants will build detailed REIT models, learning best practices for handling variables like rental income, expenses, and development projects.

2. REIT Profit Metrics:

- The course covers key profit metrics like Funds from Operations (FFO), Adjusted Funds from Operations (AFFO), and Cash Available for Distribution (CAD), teaching how to assess a REIT’s operating performance and financial health.

3. Advanced Valuation Techniques:

- Learn to use the Net Asset Value (NAV) approach, along with discounted cash flow (DCF) and other relative valuation metrics, to evaluate a REIT’s intrinsic value across different market conditions.

Who Should Enroll?

The Wall Street Prep – Real Estate Financial Modeling Course is ideal for:

- Investment Banking Professionals: Essential for those analyzing and valuing real estate investments.

- Equity Researchers and Analysts: Critical for making accurate investment recommendations.

- Real Estate Investors and Professionals: Perfect for those involved in real estate, providing tools to make informed decisions and maximize returns.

Course Enrollment and Next Steps

How to Get Started:

- Enroll Today to access the course and start learning at your own pace.

- Ongoing Support: Get instructor support and join a network of like-minded professionals for a more enriching learning experience.

Conclusion: Unlock Career Opportunities with Wall Street Prep

The Wall Street Prep – Real Estate Financial Modeling Course offers a robust foundation in real estate finance, giving you the skills to excel in the competitive world of REITs. Whether you’re starting in investment banking or refining your expertise in real estate finance, this course is designed to help you succeed. Enroll now to gain a competitive edge and master real estate financial modeling!