Description

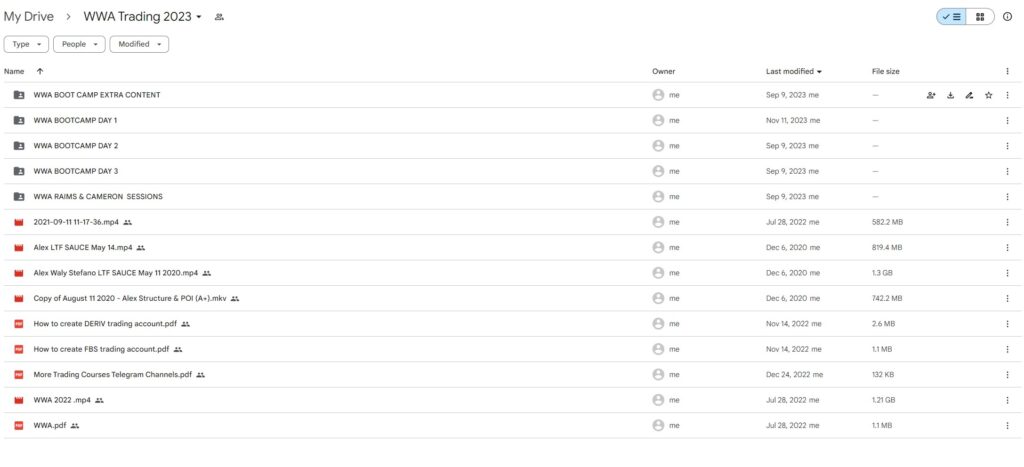

Download Proof | WWA Trading 2023 (9.16 GB)

![]()

WWA Trading 2023 is a trading education course designed to equip traders with advanced technical analysis, market insights, and risk management skills. It is typically aimed at traders in forex, stocks, and cryptocurrency markets, focusing on developing a comprehensive understanding of price action, trend analysis, and strategy building.

Here’s an outline of what WWA Trading 2023 might cover:

1. Core Foundations of Trading

- Market Structure: Understanding how different market phases (accumulation, markup, distribution, and markdown) affect trading decisions.

- Trend Analysis: Identifying and trading with trends, including techniques to differentiate between strong and weak trends.

- Key Support and Resistance Levels: Spotting important levels on charts to guide entries, exits, and profit-taking strategies.

2. Price Action and Candlestick Analysis

- Candlestick Patterns: Recognizing bullish and bearish reversal patterns and continuation patterns for timing entries.

- Advanced Price Action Techniques: Learning to trade without indicators by relying on pure price movement, focusing on specific candle formations and chart patterns.

- Multi-Timeframe Analysis: Using higher and lower timeframes to gain a more comprehensive view of market direction.

3. Technical Analysis and Chart Patterns

- Classic Chart Patterns: Identifying and trading formations like head and shoulders, triangles, flags, and wedges.

- Breakout and Reversal Trading: Techniques for capturing momentum on breakouts and spotting reversals early.

- Using Volume as Confirmation: Interpreting volume data to validate or refute price movements, strengthening trade decisions.

4. Risk and Money Management

- Position Sizing: Calculating trade size based on risk tolerance, account size, and specific market conditions.

- Stop Loss and Take Profit Strategies: Setting appropriate stop-loss levels and profit targets to protect capital and lock in gains.

- Managing Drawdowns and Capital Preservation: Strategies for handling losing streaks and maintaining consistent, sustainable growth.

5. Advanced Trading Strategies

- Swing Trading and Scalping Techniques: Tailoring strategies to capture short-term and medium-term price moves.

- News and Event Trading: Trading around economic releases, earnings reports, and other high-impact events.

- Algorithmic and Automated Strategies: Introduction to algorithmic trading tools and using them to increase efficiency.

6. Psychology and Discipline in Trading

- Building a Resilient Mindset: Techniques for managing emotions, especially during high-stress trading moments.

- Overcoming Common Mental Pitfalls: Recognizing and avoiding emotional biases like fear of missing out (FOMO) or revenge trading.

- Establishing Discipline and Consistency: Creating a routine to strengthen disciplined trading and avoid impulsive decisions.

7. Developing and Testing a Trading Plan

- Building a Personal Trading Plan: Structuring a plan that includes goals, risk parameters, and criteria for entries and exits.

- Backtesting and Optimization: How to test strategies against historical data to refine and adapt them to changing market conditions.

- Tracking and Analyzing Trade Performance: Using journaling and performance metrics to identify strengths and areas for improvement.

8. Trading Tools and Platforms

- Choosing the Right Trading Platform: Overview of popular platforms (e.g., MetaTrader, TradingView) and tools.

- Using Indicators for Additional Insight: Brief introduction to helpful indicators like RSI, MACD, and moving averages.

- Setting Alerts and Notifications: Tips for configuring alerts to stay informed about key market changes.

9. Community Access and Mentorship

- Trading Community Engagement: Connecting with other traders to share insights, strategies, and updates.

- Q&A Sessions and Mentorship: Live sessions with experienced traders for guidance, troubleshooting, and strategy refinement.

WWA Trading 2023 provides a robust, structured approach to trading with a strong focus on price action, technical analysis, and psychological resilience. It’s ideal for those looking to improve trading skills in forex, stocks, or crypto and aiming to develop a disciplined, consistent approach.